YIMBY’s 2021 Construction Report Shows 30,036 New Residential Unit Filings in New York City

YIMBY’s 2020 New Building Report, covering 2019’s numbers, showed a substantial increase in applications, with 2019’s total filings reaching 36,467. This year, the numbers have dropped somewhat, with 2020’s submitted residential units totaling 30,036. While this was a decrease, it was still substantially above the 2018 total of only 20,393 new units filed, indicating that in spite of the profound headwinds beginning in March of last year that are now seemingly abating, permitting activity remained fairly vigorous. The full report covering 1,774 new buildings and over 57 million square feet of new floor space is available in Excel format upon purchase of YIMBY’s Building Wire subscription.

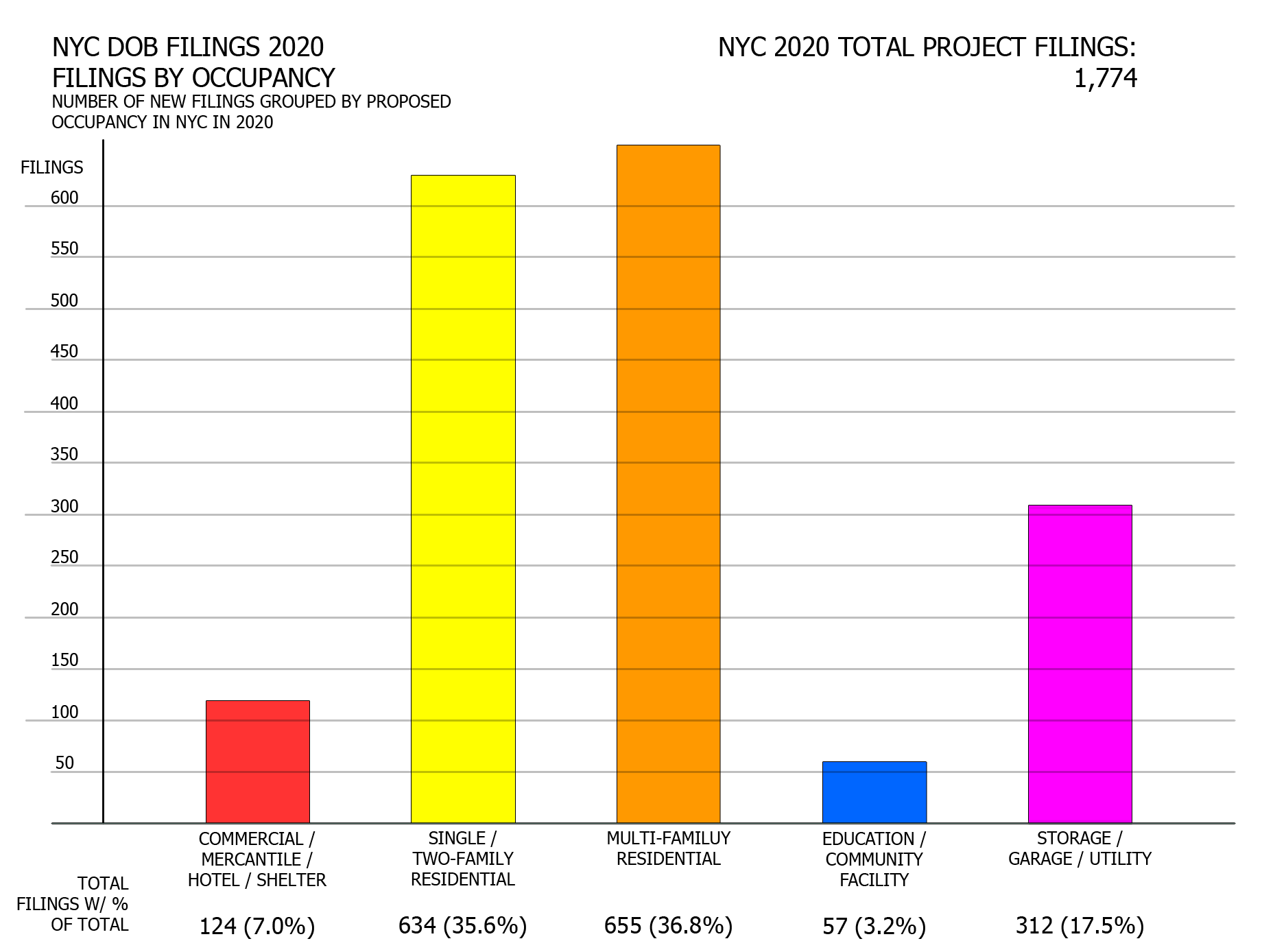

Number of filings per proposed occupancy

NYC DOB filings in 2020 by occupancy filings. Credit: Vitali Ogorodnikov

The majority of buildings in New York, or in just about any city in general, are residential, so it is hardly surprising that residential filings dominated in 2020, with 1,289 proposed projects accounting for over 71 percent of the total. Garages, an extension of residential construction, also comprise much of the storage/garage/utility category, which makes up 17.5 percent of all filings.

Notably, multifamily filings slightly outpaced the single- and two-family category, in a testament to the enduring appeal and desire for density in the city. In most other cities, including major ones such as Chicago, Philadelphia, and San Francisco (where YIMBY launched affiliate sites in 2020), single- and two-family proposals would likely predominate among residential filings.

Despite ongoing travel restrictions, the city continues to plan for future visitors. Over the course of 2020, permits were filed for 21 hotels across the city, with seven in Brooklyn, five in Queens, four each in Manhattan and the Bronx, and one in Staten Island. Together, the filings account for 2,272 new rooms. The highest room count belongs to the 33-story, 534-room hotel proposed at 32 West 48th Street just south of the Rockefeller Center in Midtown.

9 DeKalb Avenue. Photo by Michael Young

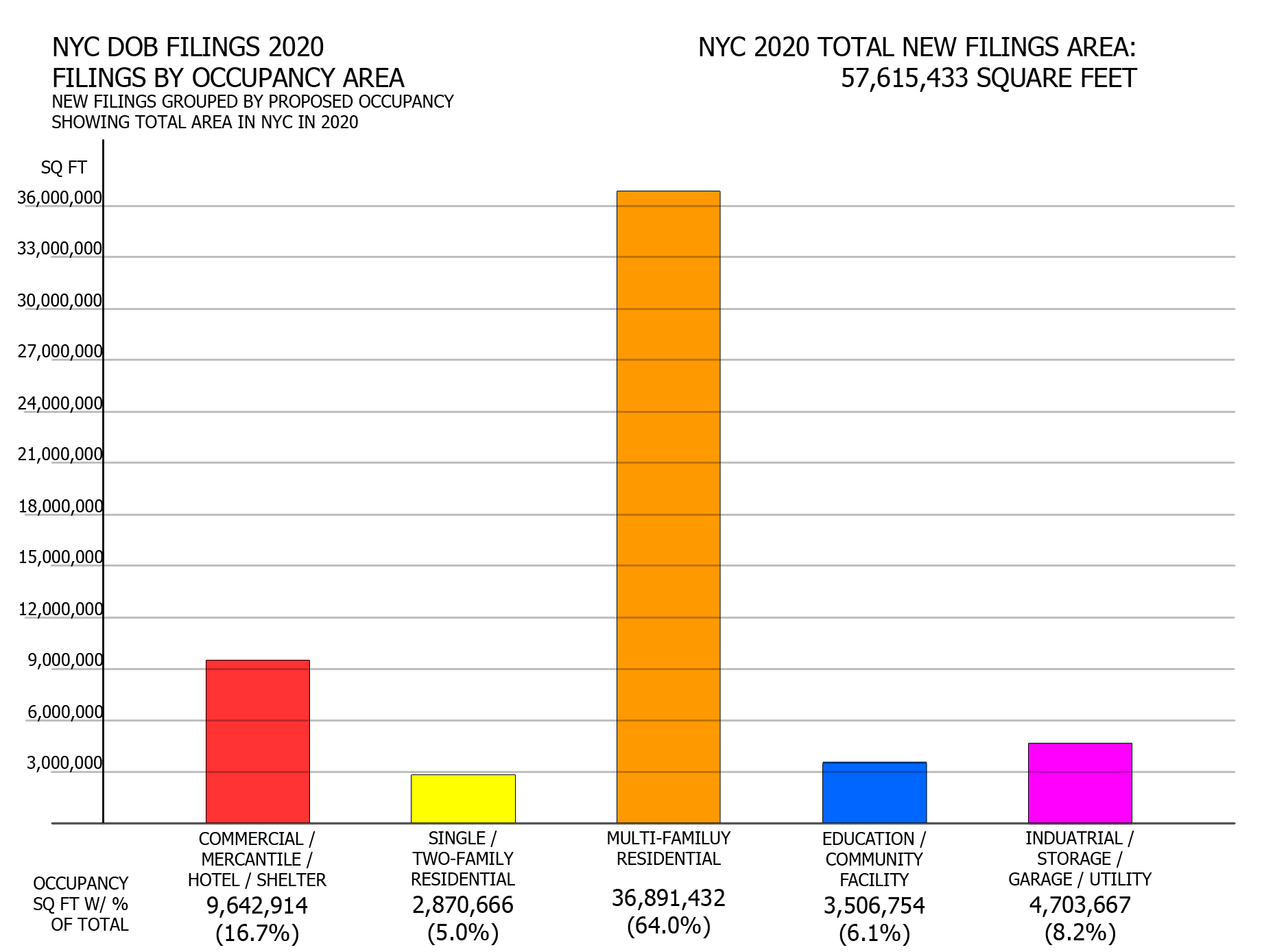

Floor area per proposed occupancy

NYC DOB filings in 2020 by occupancy area. Credit: Vitali Ogorodnikov

Despite having similar filing counts, the total square footage of multifamily filings, measuring almost 37 million square feet and nearly two-thirds of the total proposed floor area, far outweigh the 2.9 million square foot total for single- and two-family filings, due to the comparatively larger size of the average apartment building.

Amazon’s 4,993,437-square-foot distribution center, proposed at 526 Gulf Avenue in Staten Island, accounts for more than half of the commercial category’s 9.5-million-square-foot total, and almost nine percent of all floor space proposed in the city in 2020. The combined floor area for planned hotels accounts for nearly 1.2 million square feet. Office and retail comprise most of the remaining commercial space.

Hudson Yards. Photo by Michael Young

Filings grouped by floor count

NYC DOB filings in 2020 by floor count. Credit: Vitali Ogorodnikov

Despite their prominence on the skyline, tall buildings make up a minority of the city’s total building stock, as they also do in the filing tally sorted by floor count. The majority of the buildings proposed in 2020 are slated to rise between one and four stories high, with buildings between five and 19 floors making up much of the remainder.

While the 26 buildings proposed at 20 stories and higher is a paltry number compared to the group above, it is still a considerable figure in its own right. When grouped together, the resulting cluster would rival the skylines of most of the nation’s mid-sized cities.

Contrary to expectations of finding the tallest permit filings in Manhattan, the seven proposals with the highest floor counts are all located in Brooklyn, Queens, and the Bronx, reflecting the enduring strength of the boroughs’ real estate markets. The development with the highest floor count is the 49-story residential tower proposed at 180 Ashland Place in Fort Greene, Brooklyn. The 48-story skyscraper proposed at 23-14 45th Avenue in the Court Square district in Long Island City, Queens, takes a close second place. At number three is the 43-story, 710-unit high-rise apartment building proposed at 355 Exterior Street in Mott Haven in the Bronx, which will become one of the borough’s tallest buildings and its tallest built so far in the current millennium.

1 Bell Slip (second from left). Photo by Michael Young

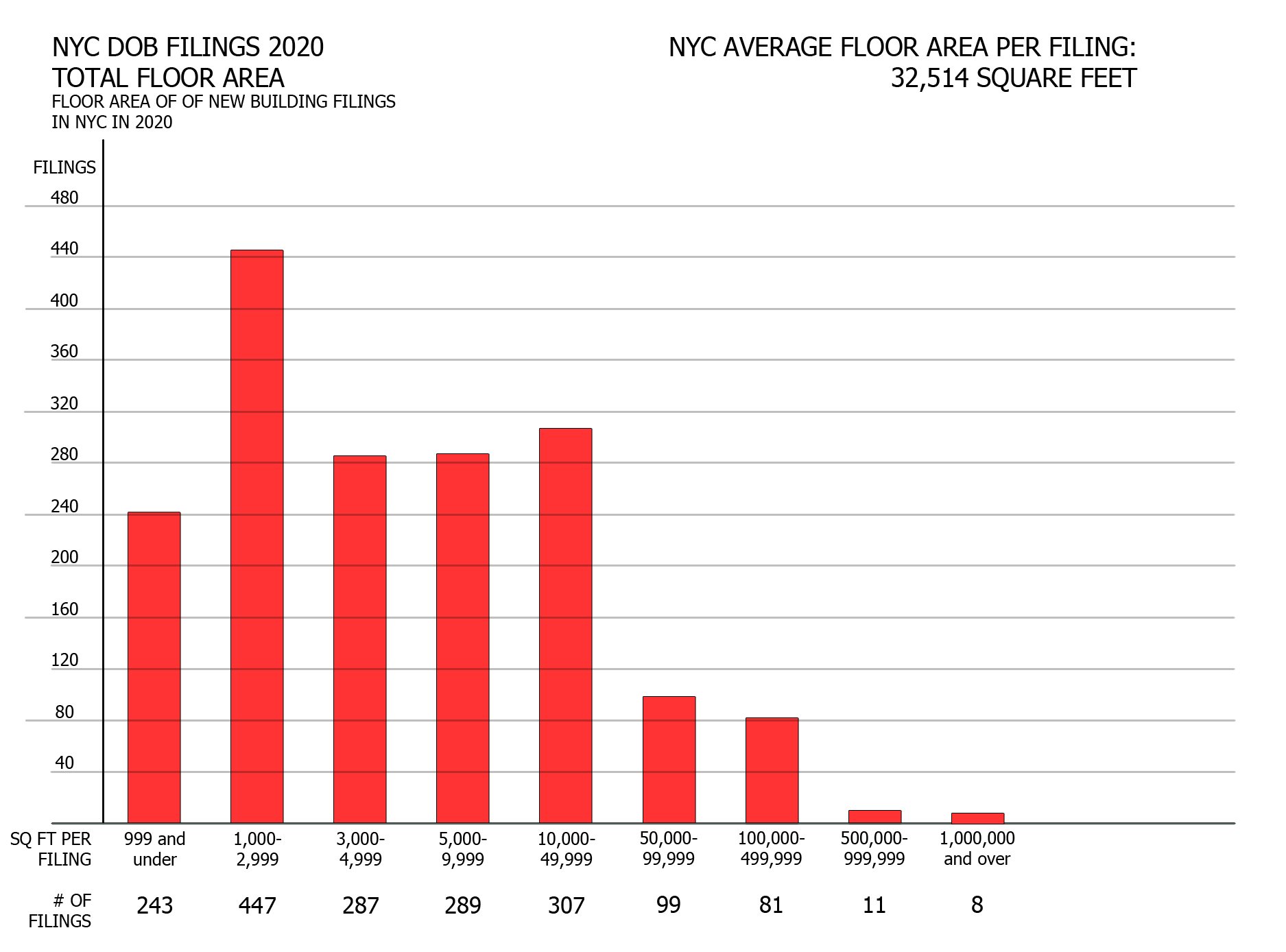

Filings grouped by floor area

NYC DOB filings in 2020 by floor area. Credit: Vitali Ogorodnikov

The floor count chart showed that the majority of proposals fall within the low- to mid-rise category, and grouping by total floor space confirms this finding. Most of the filings span from garages, which average around 315 square feet apiece, to 50,000 square feet, roughly equivalent to a 100-unit apartment building.

However, over the course of the year, the city has also received applications for 199 buildings measuring 50,000 square feet and above, reflecting a continued real estate appetite for major construction. Of these, 19 structures would pack over half a million square feet and eight more would span over a million square feet.

The largest proposal is the nearly 5 million square foot Amazon facility planned at 526 Gulf Avenue in Staten Island. The smallest is a 119-square-foot garage filed at 1933 East 14th Street in Brooklyn. A number of garages did not list any square footage or just one square foot, so for statistical purposes we averaged such structures at 315 square feet apiece. If the fine folks at the Department of Buildings are reading this article, please encourage your applicants to adhere to stricter standards.

Aside from the Staten Island facility, the rest of the million-square-foot-plus developments are all multifamily residential, measuring between 1.1 and 1.7 million square feet each. Five will be located in the Bronx and two more are slated for Queens.

130 William Street. Photo by Michael Young

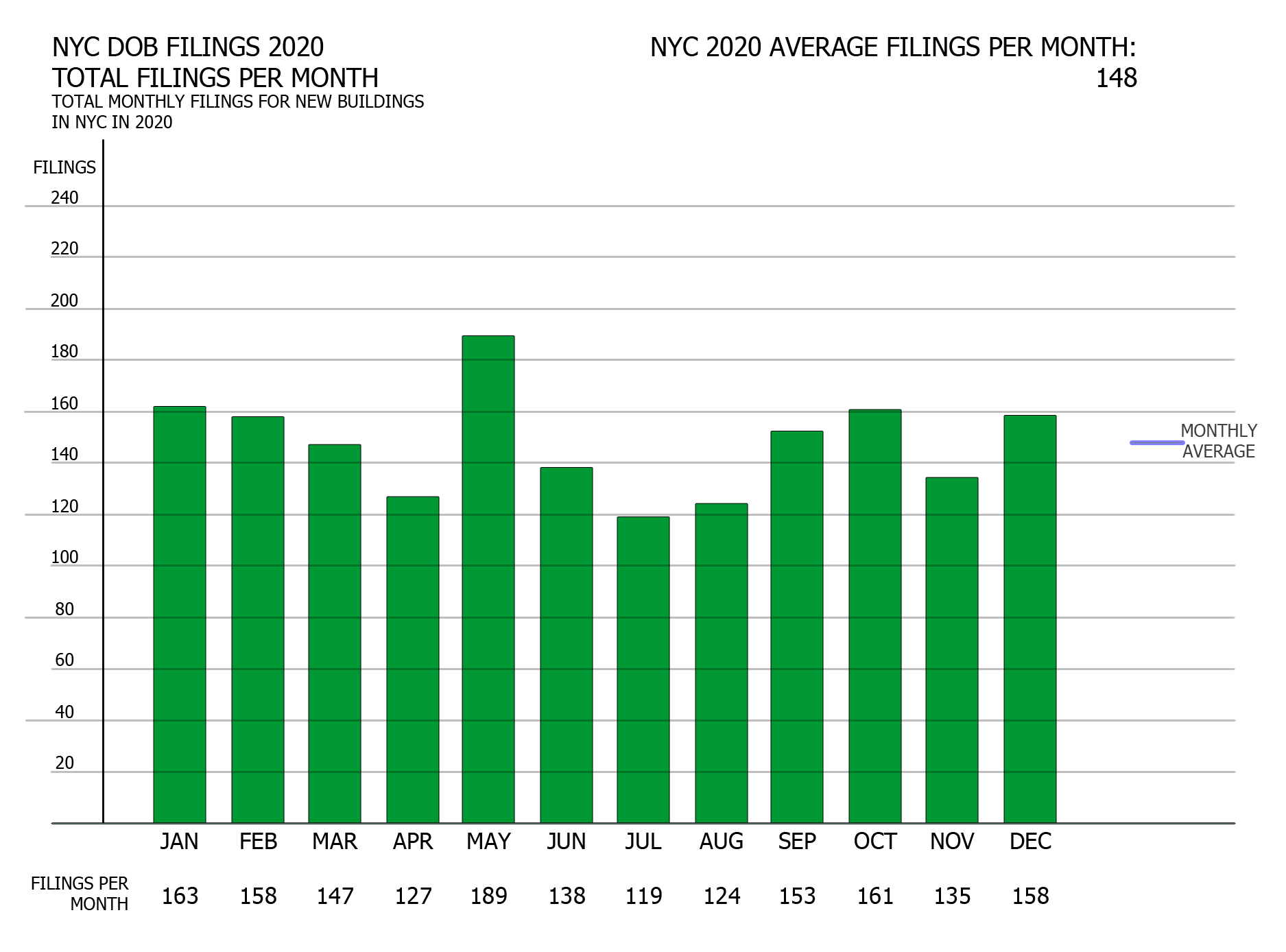

Filings grouped by month

NYC DOB filings in 2020 by month. Credit: Vitali Ogorodnikov

The traumatic events that hit the city at the beginning of the year prompted speculation about an incoming construction and real estate crash. In contrast, the city boldly affirmed its resiliency and desire for grow with monthly filing counts that have remained largely unchanged, with only a slight dip around the summer.

The Ronald O. Perelman Performing Arts Center. Photo by Michael Young

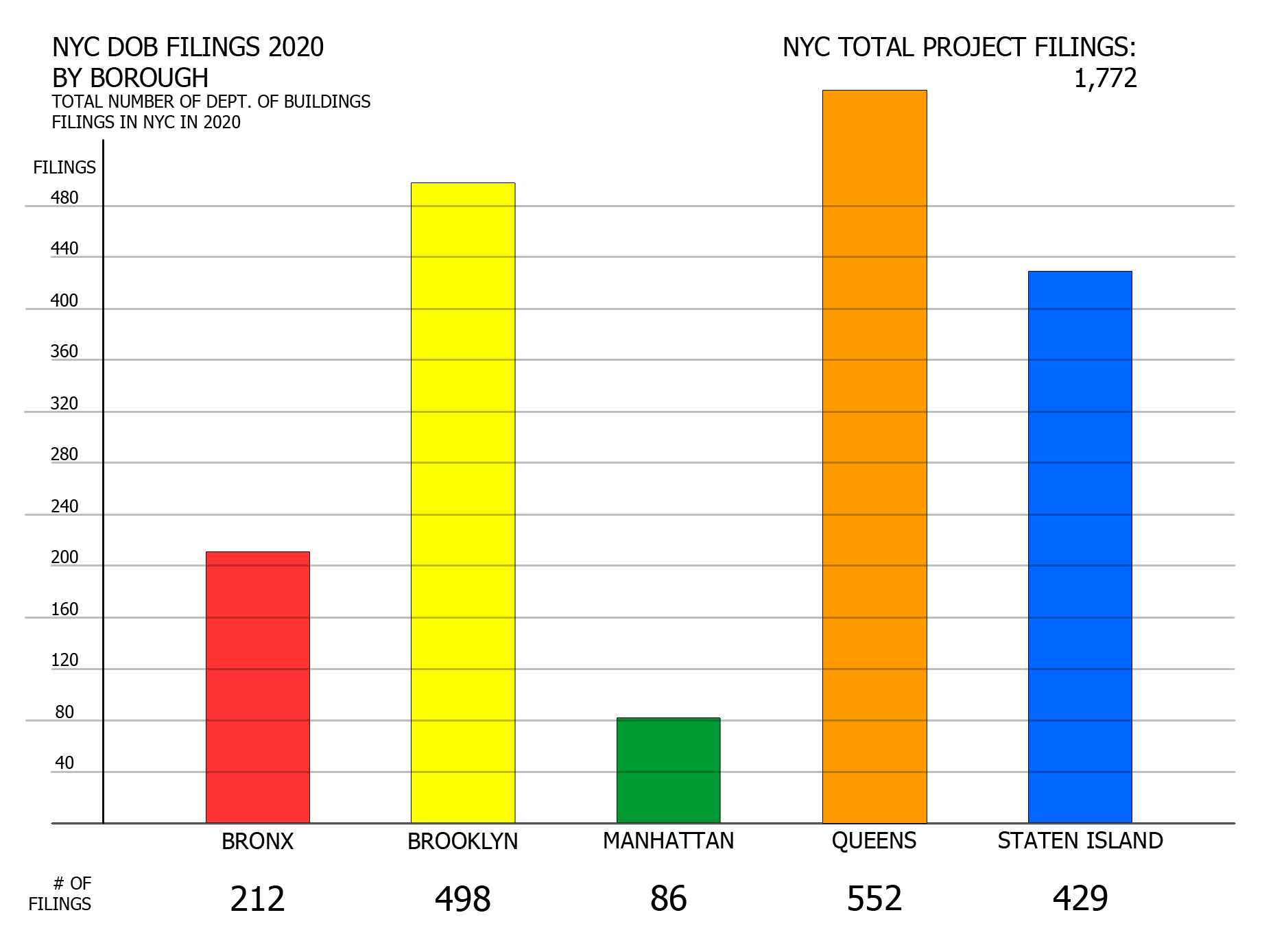

Number of filings by borough

NYC DOB filings in 2020 by borough. Credit: Vitali Ogorodnikov

Manhattan, by far the most densely populated major urban area in the United States, saw its initial build-out nearly a century ago. As such, it is not surprising to see that most developments proposed last year will be located in the remaining four boroughs, which offer more room for growth.

Queens leads the pack with 552 filings, with Brooklyn in a close second at a total of 498. Staten Island is not far behind with 429 flings, a number boosted by the large volume of single- and two-family houses and garages. The Bronx is nest with 212 filings, and Manhattan trails far behind with 86 new building permits.

Long Island City. Photo by Michael Young

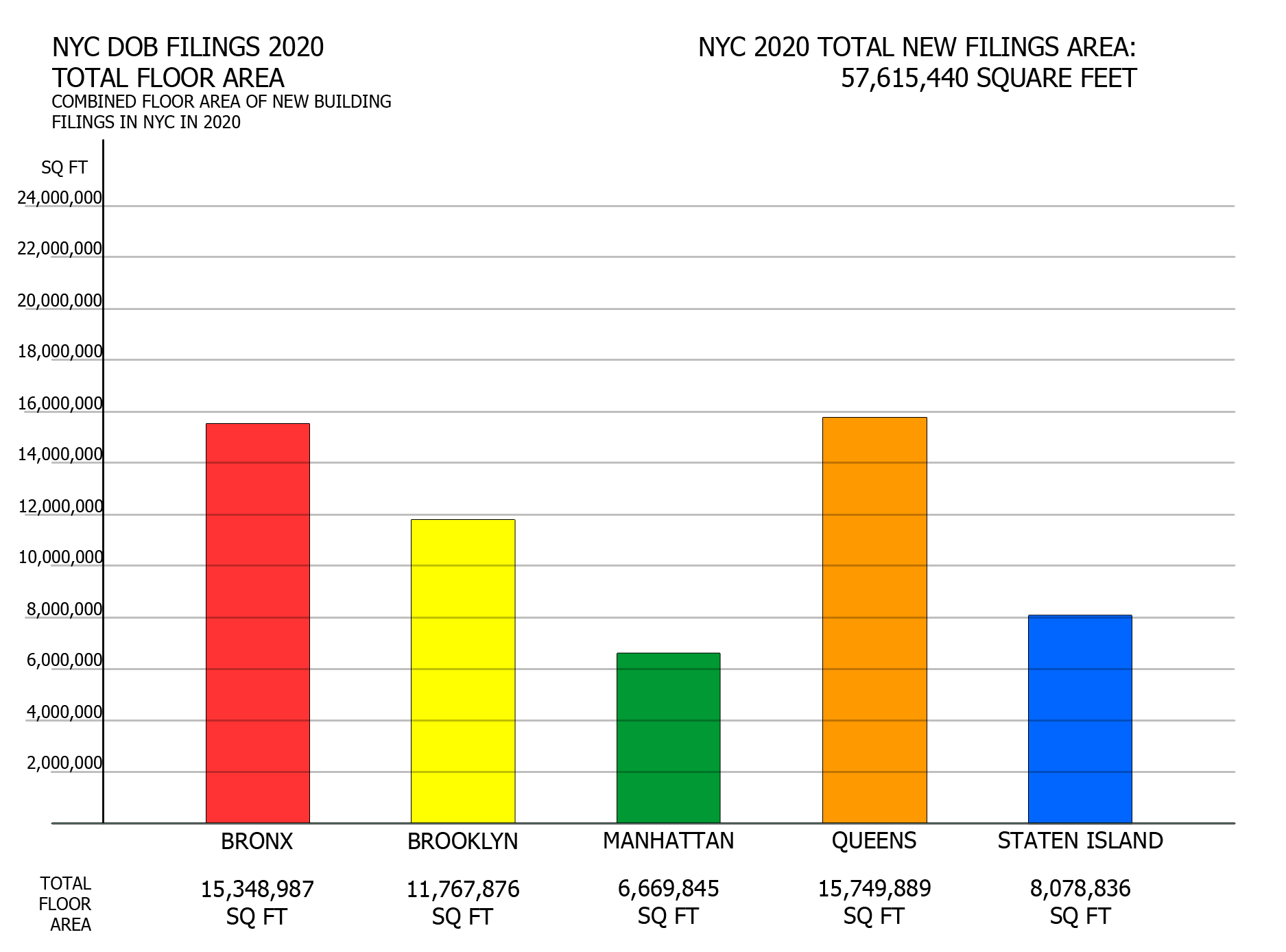

Total proposed floor area per borough

NYC DOB filings in 2020 by total floor area. Credit: Vitali Ogorodnikov

Queens leads the boroughs not only in the total filing count, as discussed above, but also in the amount of the proposed square footage, with 15.8 million square feet added to the drawing boards in 2020. The Bronx nearly matches the figure, with over 15.3 million square feet. Though Brooklyn and Staten Island both count more filings than the Bronx, they lag behind in total square footage, with 11.8 and 8.1 million square feet, respectively. Manhattan comes in last with 6.7 million square feet. Though the figure amounts to slightly less than half of Queens’ total, the discrepancy is less than the two boroughs’ tenfold-plus difference in filing count. In all, the results paint a bright picture of robust growth across the city as a whole.

As mentioned earlier, the city’s largest building proposed in 2020 is Amazon’s 4,993,437-square-foot distribution center planned at 526 Gulf Avenue in Staten Island, which accounts for 62 percent of all square footage proposed in the borough. At numbers two, three, and four are three buildings proposed at 1850, 1852, and 1860 Lafayette Avenue in Soundview in the Bronx, each measuring over 1.6 to 1.7 million square feet. Two more buildings planned at 621 and 675 Brook Avenue, also in the Bronx, are set to span over 1.1 million square feet each, taking the eighth and ninth spots.

In Queens, two nearly 1.5-million-square-foot structures planned at Rockaway Village at 20-12 and 21-02 Mott Avenue in Far Rockaway and a 771,262-square-foot apartment building proposed at 43-14 Queens Street in the Court Square section of Long Island City take the sixth, seventh, and tenth place, respectively.

Rendering of Rockaway Village via Marvel Architects

Average floor count per borough

NYC DOB filings in 2020 by average floor count. Credit: Vitali Ogorodnikov

Manhattan’s dense cityscape and and high real estate prices prompts developers to build upwards wherever possible. Its average of 11.5 floors per filing, almost triple the city average, is the result of consistently high floor counts rather than a few average-disrupting outliers, as the highest floor count of any proposal in the borough (33-story hotel proposed at 32 West 48th Street) ranks only at number eight in the city at large.

The average floor count of 5.8 per filing in the Bronx is roughly half that of Manhattan, with Brooklyn lagging slightly behind at 4.8 and the Queens further down at 3.2. Curiously, the tallest buildings (by floor count) proposed over the past year in all three boroughs significantly surpass the highest-floor proposal in Manhattan. Brooklyn’s 180 Ashland Place will rise 49 stories, 23-14 45th Avenue in Queens will stand 48 stories tall, and 355 Exterior Street in the Bronx will count 43 floors.

Unsurprisingly, sprawling Staten Island trails well behind the rest of the boroughs. However, its average of 2.3 floors per filing is still a surprisingly strong showing given that a large portion of the filings are single-story garages and single-family buildings. The tallest building filed in the borough is the 12-story, 274-unit high-rise planned at 475 Bay Street.

Exterior View of Construction at 425 Park Avenue – Photo by Alan Schindler

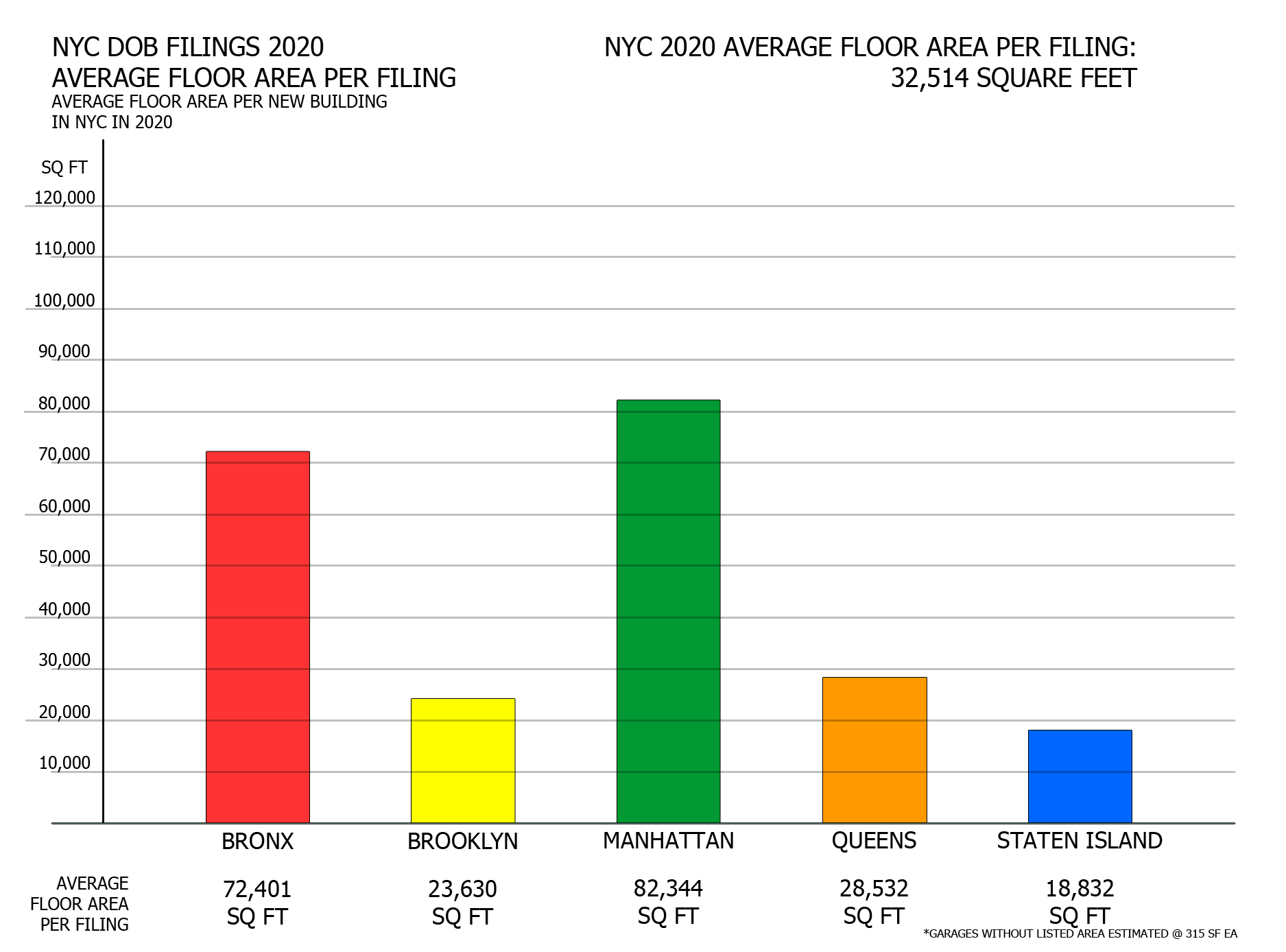

Average floor area per borough

NYC DOB filings in 2020 by average floor area. Credit: Vitali Ogorodnikov

While none of Manhattan’s filings crack the city’s top-ten largest buildings planned in 2020, the borough’s average of 82,344 square feet per filing is the highest in the city, reflecting the borough’s century-long trend of constructing predominantly large buildings. The largest building proposed in Manhattan is a 537,422-square-foot community facility filed at 603 West 218th Street in Inwood.

The Bronx trails slightly behind with an average of 72,401 square feet per filing, since the borough has also embraced large-scale planning over the past year. Two 1.7 million square foot residential buildings proposed at 1850 and 1860 Lafayette Avenue are tied for first place, each measuring 1,661,644 square feet.

Queens and Brooklyn average 28,532 and 23,630 square feet per filing, respectively, two middle-of-the-road figures that hint at a more balanced mix of large and small-scale proposals. The largest building proposed in Queens is the 1,420,102-square-foot apartment building proposed as part of Rockaway Village in Far Rockaway, in the borough’s southeast corner near the city line. Brooklyn’s largest 2020 proposal is the 41-story, 584,686-square-foot tower planned at 698 Atlantic Avenue as part of the Pacific Park complex.

Staten Island’s average of 18,832 square feet per filing reflects its predominantly small-scale construction market. Without a single outlier, Amazon’s nearly 5 million square foot facility proposed at 526 Gulf Avenue, the borough’s average floor area per filing would plummet to a paltry 7,209 square feet. Only five proposals span over 100,000 square feet. However, it also features some staggeringly large single-family filings, namely the 19 houses proposed from 1059 through 1091 Richmond Road and 71 through 119 Meadows Avenue, each measuring 51,706 square feet. Perhaps this is the result of a filing error: maybe the developer, which is the same for all 19 filings, accidentally added the grand total for all as individual house areas. Otherwise, each of the houses would span more space than the second-largest apartment building planned in the borough last year, the 33,305-square-foot, 35-unit structure planned at 32 Sylvaton Terrace near the Narrows in Rosebank.

50 Hudson Yards (center) between The Spiral (left) and 30 Hudson Yards (right). Photo by Michael Young

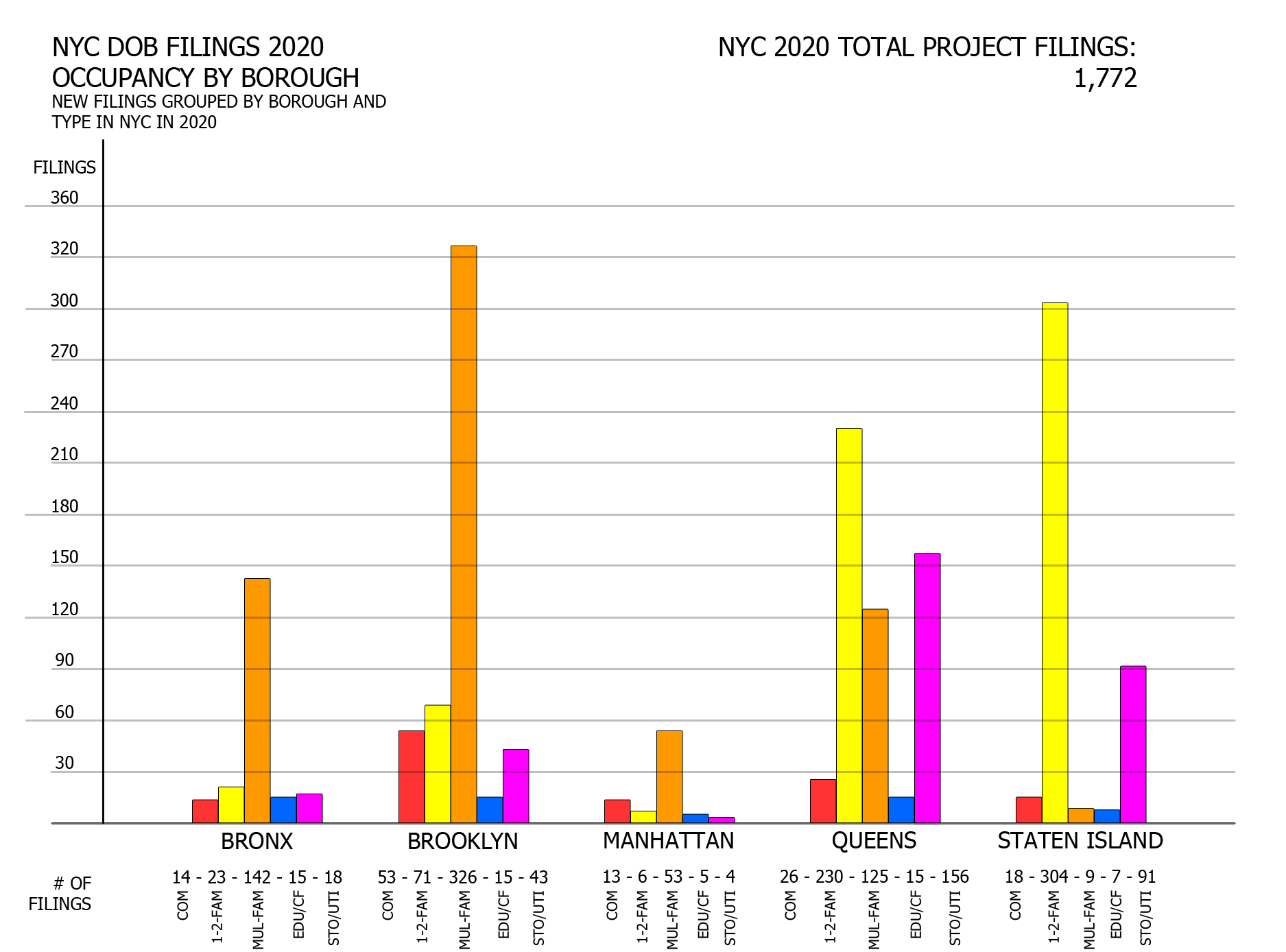

Filings by borough and occupancy type

NYC DOB filings in 2020 by borough by occupancy. Credit: Vitali Ogorodnikov

Sorting filings by borough and by occupancy reveals two salient trends. First, residential buildings will continue to dominate the construction market in the coming years, at least in their quantity.

The second is that the boroughs appear to maintain their density status quo. Developers in the intensely urban Bronx, Brooklyn, and Manhattan are sticking almost exclusively to multi-family structures. Their counterparts in suburban-flaired Staten Island opt for one- and two-family housing, many with separate filings for garages (generally filed under “storage”). Huge and diverse Queens presents the most balanced mix of planned low- and high-density construction of any borough.

Skyline Tower. Photo by Michael Young

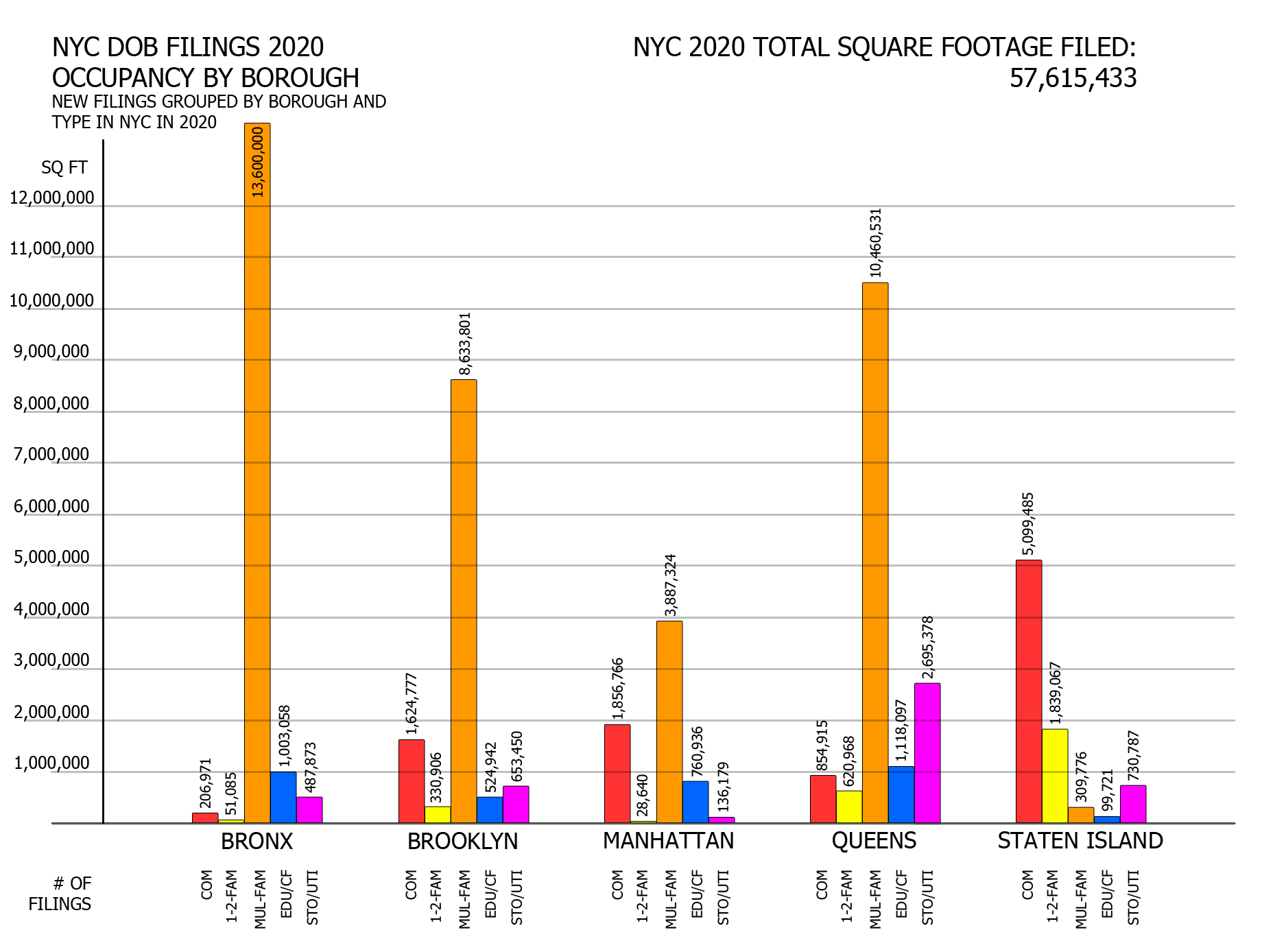

Filings by borough and occupancy by area

N

YC DOB filings in 2020 by borough by floor area per occupancy. Credit: Vitali Ogorodnikov

The total square footage per occupancy category planned in each borough in 2020 reflects the trends discussed above, only further amplifying the predominance of multifamily construction in most boroughs. The Bronx is the clear leader in terms of total multi-family square footage filings, with its 13.6 million square feet accounting for 89 percent of the borough’s total proposed floor area. The dynamic is similar, albeit less pronounced, in Brooklyn, Manhattan, and Queens, each featuring less total area for multifamily housing and a greater share of other uses, though the former is still prevalent in each of the three boroughs.

Commercial area dominates only in Staten Island, though the lion’s share of the figure comes from Amazon’s 4,993,437-square-foot distribution center proposed at 526 Gulf Avenue.

601 West 29th Street. Photo by Michael Young

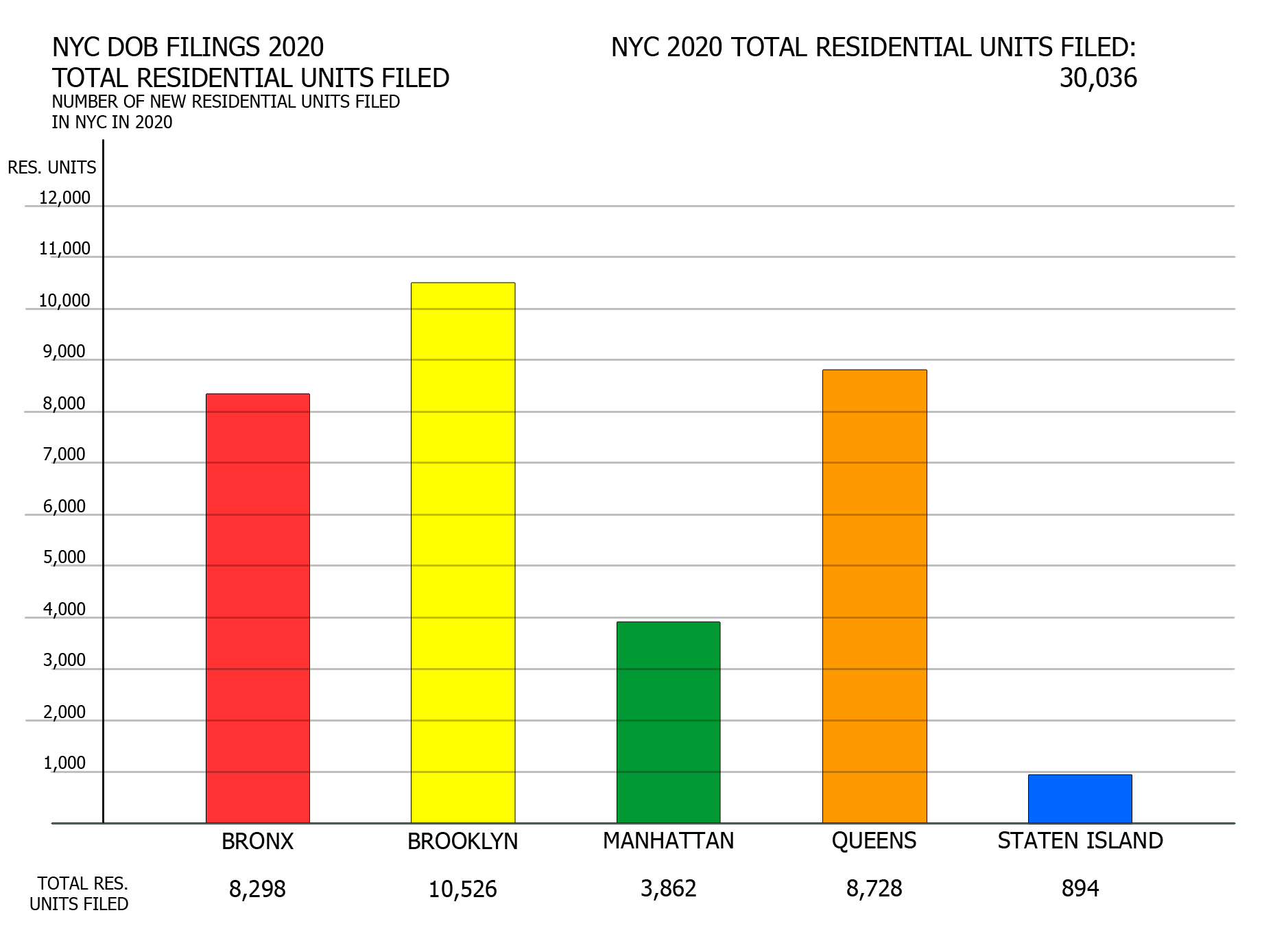

Total proposed units per borough

NYC DOB filings in 2020 by residential units filed. Credit: Vitali Ogorodnikov

As shown in the previous chart, the Bronx is the clear leader in terms of total planned residential space, so it is curious to see both Brooklyn, and to a lesser extent, Queens edging it out in terms of total planned residential units. But leaving the puzzling question of whether differing unit sizes or common area layouts are an explanation, it is encouraging to see thousands of apartments planned in nearly every borough last year, though the city must still further relax its burdensome zoning restrictions to allow for greater residential growth.

9 DeKalb Avenue. Photo by Michael Young

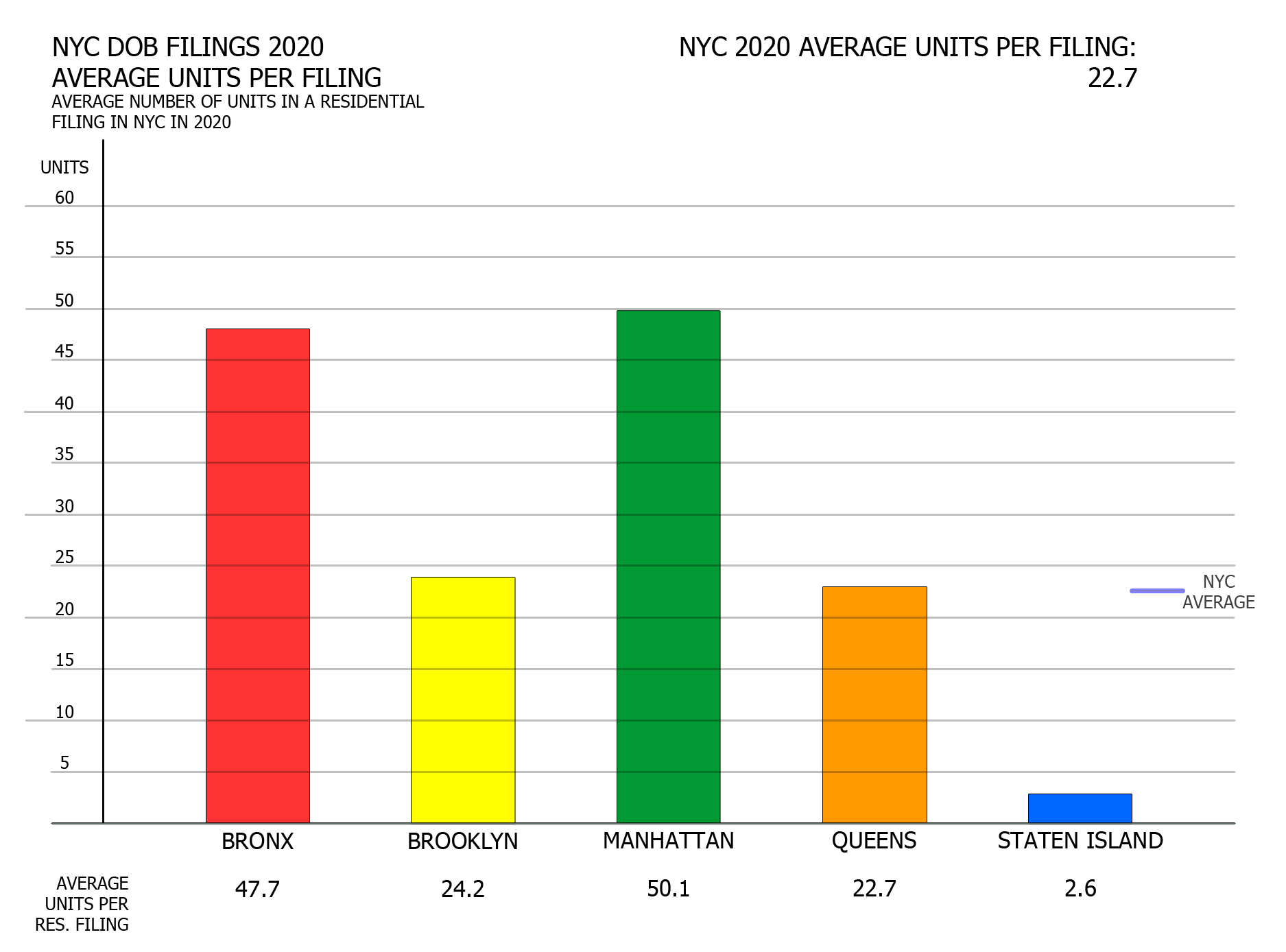

Average number of units per residential filing per borough

NYC DOB filings in 2020 by average units per filing. Credit: Vitali Ogorodnikov

The chart above is yet another affirmation of trends discussed in several analyses above. The generally large apartment buildings planned in Manhattan and the Bronx yield averages of 50.1 and 47.7 units per filing, respectively. Staten Island’s average of 2.6 units per filing reflects the borough’s prevailing low density. Brooklyn and Queens are amply zoned for both typologies, leading to in-between figures of 24.2 and 22.7, respectively. Curiously, the average unit count per residential filing in Queens matches the overall city average.

Central Park Tower. Photo by Michael Young

Outlier

As we pointed out in our second and third quarter reports, apparently Chuck Norris keeps planning to build a 10,000-foot-tall, 30-story office tower with a total floor area of 12 square feet. By the end of the year, the actor has planned five such buildings, all at the non-existent Manhattan address of 1 Bogus Lane. As entertaining as such bogus filings may be (the above are test permits created by the Department of Buildings), they would dramatically throw off any automatic or otherwise careless data collection and analysis.

Fortunately, the above data was carefully screened on an item-by-item basis and pruned not only of what seem to be pranks by city agencies, but also of hundreds of duplicate and otherwise erroneous permit filings to present YIMBY readers with the most accurate and reliable information available.

At the start of the tumultuous year, skeptics wondered whether we ought to write off the city as we know it. In defiance of such pessimism, the city has once again proven its resilience and a desire to move forward and upward. The sheer volume of permits filed over the course of 2020 clearly illustrates the enduring vivacity of the nation’s largest city and the continued motion the economic, cultural, and social dynamo of New York City.

Billionaires’ Row. Photo by Michael Young

Subscribe to YIMBY’s daily e-mail

Follow YIMBYgram for real-time photo updates

Like YIMBY on Facebook

Follow YIMBY’s Twitter for the latest in YIMBYnews