Mid-America Apartment Stock: Great Holding At The Right Price (NYSE:MAA)

dszc/iStock via Getty Images

Thesis: Buy, But At What Price?

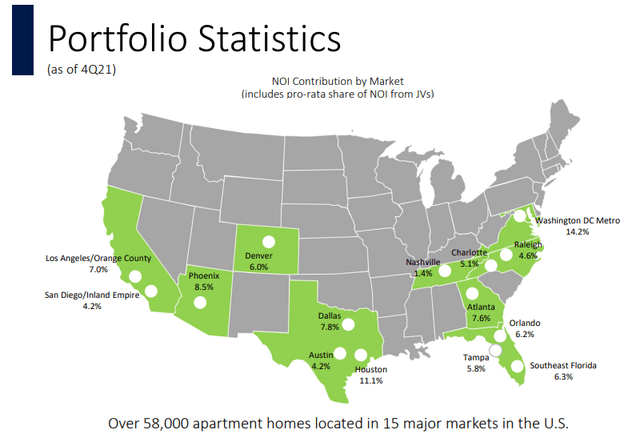

Mid-America Apartment Communities (NYSE:MAA) is an overwhelmingly Sunbelt-concentrated multifamily real estate investment trust (“REIT”) with a solid track record of financial conservatism and slow-and-steady growth. The REIT makes a great core holding in a dividend growth portfolio, and it also acts as a strong inflation hedge, as evidenced by both its share price performance and rent growth over the last few years.

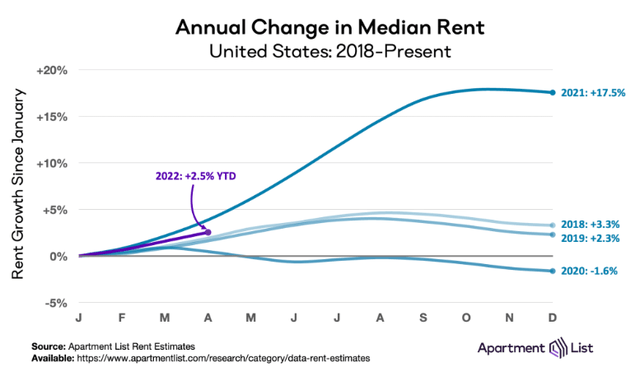

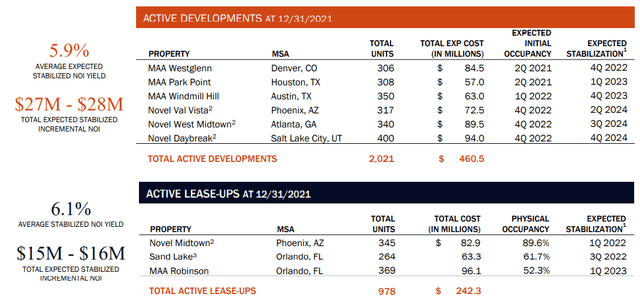

Unless you live under a rock (undoubtedly cheaper than living in an apartment), you’re probably aware of the incredible rent growth seen across the country in the last year or so.

Apartment List

This has been especially true of Sunbelt cities like Atlanta, Austin, Dallas, Phoenix, Miami, Tampa, and Las Vegas, where in-migration accelerated in the wake of the pandemic. These are precisely the markets where MAA’s apartment communities are focused.

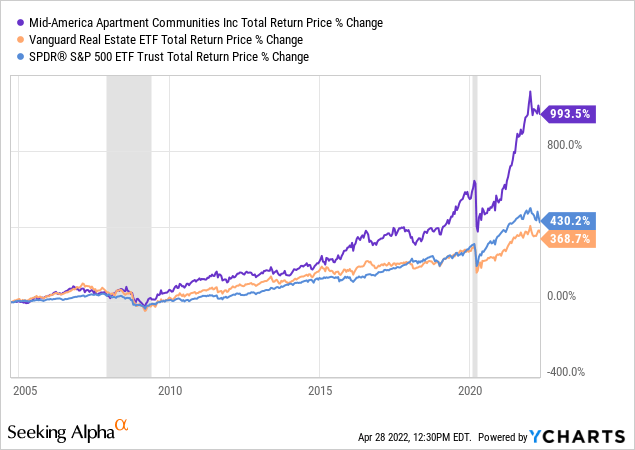

Overall, my view is that MAA is a well-diversified, well-rounded, and well-run multifamily landlord with a solid record of providing market-beating shareholder returns.

The downside is that the market knows what a great inflation hedge MAA makes and has valued the stock richly as a result. My goal in this article, then, is to determine a good buy price for MAA in light of its strong recent performance.

But first, let’s get a quick update on the REIT and its Q1 2022 results.

Update On Mid-America Apartments

There are two broad definitions of the “Sunbelt” region of the United States. Some would say it goes from the southern half of California through Arizona and New Mexico to Texas and then to the Southeast, with Tennessee and North Carolina as the cutoff.

By this definition, MAA’s major Sunbelt multifamily peer Camden Property Trust (CPT) has about 80% of its portfolio located in the Sunbelt.

Camden Property March Presentation

Others would define “Sunbelt” more narrowly to cut off California from the above description because it is a high-cost coastal market. Florida is certainly becoming higher cost, but it has not traditionally been considered part of the expensive “coastal” regions, which basically refer to the West Coast and the Northeast.

By this second definition, MAA is even more of a Sunbelt REIT than CPT is, with less exposure to the Washington D.C. area and no exposure to California.

MAA March Presentation

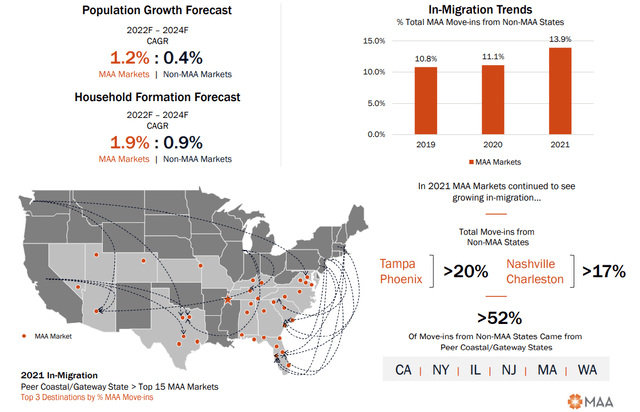

While net migration into the Sunbelt predates COVID-19, MAA did go into the pandemic incredibly well-positioned to benefit from the accelerated in-migration to Florida, Texas, Arizona, and the Southeast generally.

MAA March Presentation

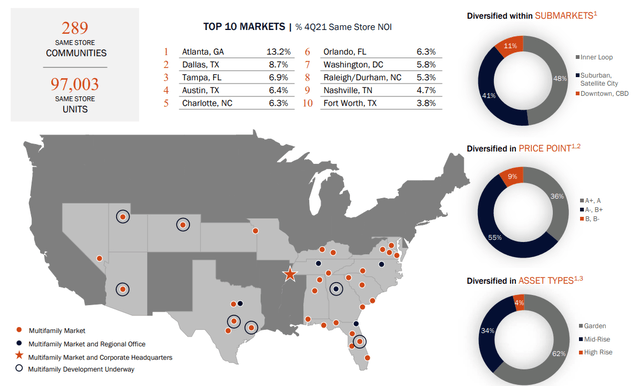

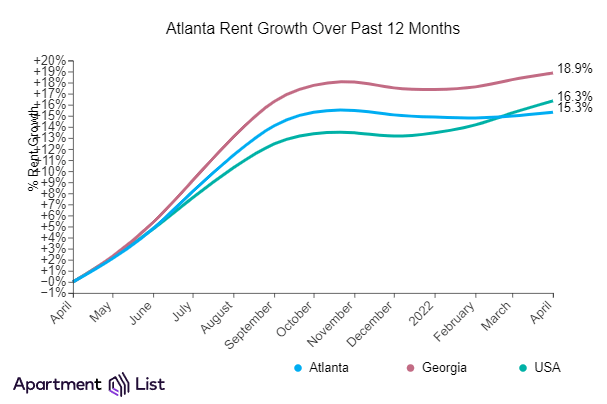

I won’t go through all of MAA’s top ten markets, but to get a sense of the portfolio’s strong geography, let’s go through some third-party data on rent growth for the top five markets (courtesy of Apartment List).

Here’s Atlanta, which narrowly slipped behind the national average in April after a strong year preceding it.

Apartment List

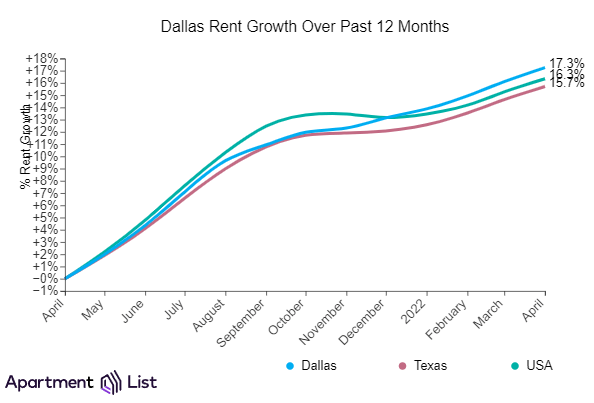

Now here’s Dallas, where rent growth sits one percentage point above the national average as of April.

Apartment List

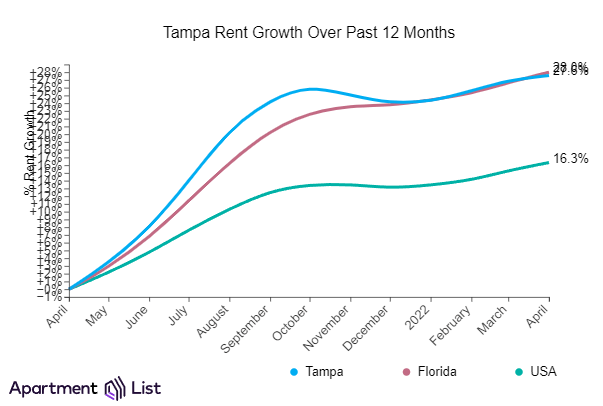

Next up is Tampa, which has enjoyed the most rent growth of any market in the nation since March 2020, according to Apartment List. Since then, Tampa has seen average rent growth of 41%. Year to date, Tampa’s rent growth has converged with that of Florida more broadly – both well above the national average.

Apartment List

Florida’s strong rent growth is good news for MAA, as the R

EIT has properties spread all across the Sunshine State.

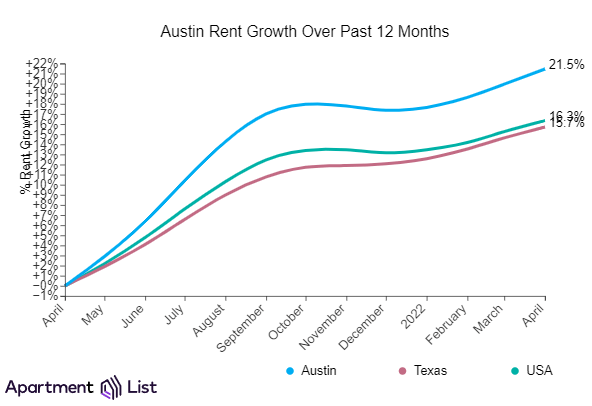

MAA’s fourth largest market is Austin, Texas, where I personally live (yes, I know – Austin from Austin). As I am painfully aware, Austin’s rent growth has been very strong in the last year as tech workers have flocked to the city and Teslas have congested the highways.

Apartment List

Finally, Charlotte has also exhibited strong rent growth in the last year, though not quite as strong as North Carolina more broadly (largely due to the Raleigh/Durham market).

Apartment List

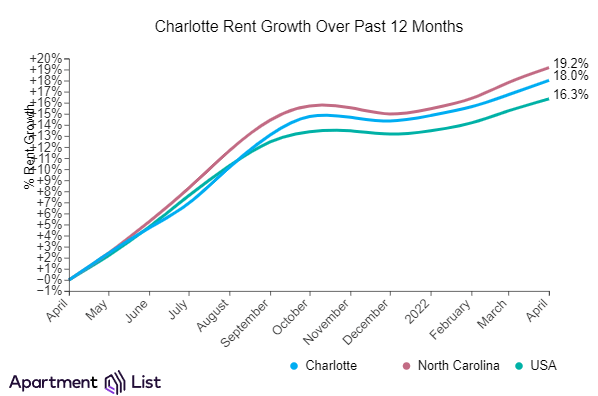

MAA’s basket of markets are not only strong because of the demand side, however. After all, the inventory of new apartments could grow equally fast as demand from residents, which would generally translate into flat rent growth. But that is not the case, as the job growth in MAA’s markets has significantly outpaced completions of new apartments in 2021 and is expected to do so again this year.

MAA March Presentation

Developers simply can’t build new units fast enough to meet demand, a situation that is greatly exacerbated by supply chain issues and construction cost inflation.

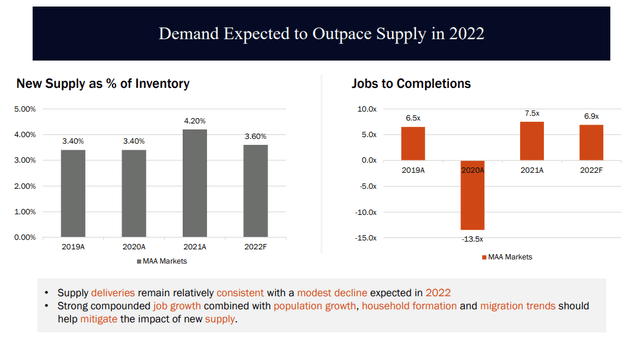

Another point in MAA’s favor is that the REIT also develops new properties in-house. This is a competitive advantage over any peers that can only acquire existing properties, since stabilized development yields are meaningfully higher than cap rates.

Here’s an image from March showing MAA’s development pipeline. As of April 27th, however, the number of active development projects dropped to five, as two were completed during the quarter and another was added.

MAA March Presentation

Note that even in the month and a half since MAA’s March presentation, from which the above image comes, the expected stabilized NOI yield on active development projects has declined to 5.7%. This, presumably, is the result of higher construction costs.

Management appears to have done a good job of reloading the development pipeline, as they reported in the Q1 press release that, over the next 18 to 24 months, MAA expects to begin development of new properties on 4-6 land parcels that are either already owned or under contract.

Despite higher expenses, MAA turned in a phenomenal Q1 report, showing 20% year-over-year growth in both core FFO and AFFO as well as 16.9% growth in same-property net operating income (“NOI”). Blended (new and renewal) rent growth in Q1 came in at a strikingly high 16.8%.

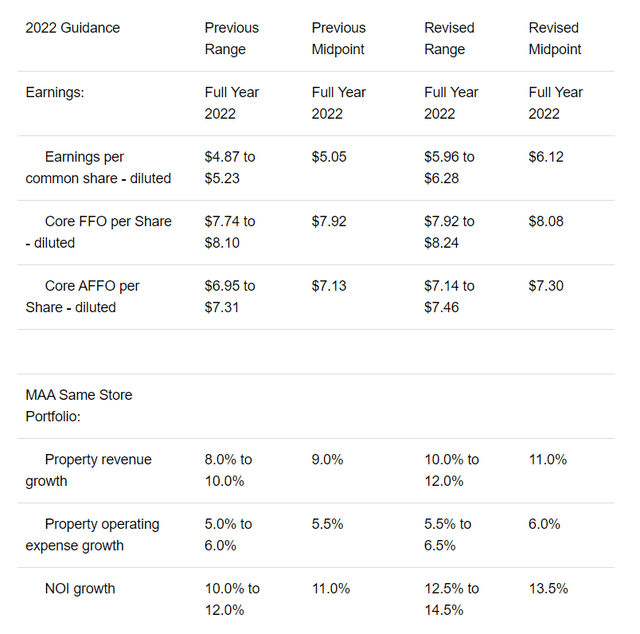

Due to base effects (comparisons against the prior year period), Q1 2022 may turn out to show the highest rent growth rates, but that does not mean that the rest of the year will be weak. In fact, MAA raised its guidance for 2022’s FFO as well as revenue and NOI growth.

Compared to Q1’s same-property NOI growth of 16.9%, MAA expects the same metric to fall in the range of 12.5% to 14.5% for the full year.

MAA Q1 2022 Press Release

Occupancy of 95.9% is very high, though with some room for further lease-up, and resident turnover of 44.7% continues MAA’s multi-year downward trajectory of resident turnover.

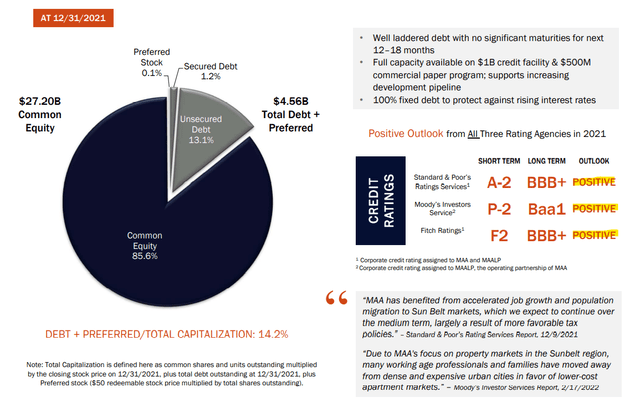

The balance sheet is also quite strong, with low debt to adjusted asset value of about 30%. Notice also that MAA’s credit rating of BBB+ enjoys a positive outlook from all three major ratings agencies. It would not be surprising to see the REIT earn an upgrade to the coveted A-tier rating in the future.

MAA March Presentation

As of the end of March 2022, net debt to EBITDA sits at 4.27x, down from 4.34x at the end of 2021. Meanwhile, the weighted average maturity of debt sits at 8.4 years, down from 8.7 years at the end of 2021, and the weighted average interest rate of 3.4% remained unchanged quarter-over-quarter.

There are other reasons to like MAA besides the strong portfolio positioning, skillful execution, and fortress balance sheet.

One of them is the management team itself. The average tenure of executives at MAA is over 20 years. The CEO, Eric Bolton Jr., has been at the company since 1994, was promoted to Chief Operating Officer in 1996, later promoted to President later in the same year, and subsequently became CEO in 2001.

The dividend consistency is another strength. In the 28 years since going public, MAA has never cut its dividend, although the dividend was frozen from 2008 through 2010. MAA’s dividend payout strikes me as one of the safest in REITdom.

What Is A Fair Price For MAA?

So, what is a fair price to pay for MAA?

As I write this on April 28th, MAA is trading at 28.1x the midpoint of 2022 AFFO and 25.4x the midpoint of core FFO. The AFFO yield is 3.6%, and the core FFO yield is 3.9%. Obviously, this is a pretty rich valuation for a REIT.

Moreover, the big risk I see is overpaying for MAA around the proximity of peak rent growth and peak optimism. After an 81% surge in MAA’s stock price in 2021, the market appears to be struggling to determine just how much more optimism should be priced in.

Candidly, so am I.

I would really like to own more of MAA. I do already have a mid-sized position in it, but I would like to make MAA a core holding. Apartment REITs have historically outperformed the real estate and broad market indexes, and I believe Sunbelt apartments will continue to outperform for the foreseeable future.

MAA enjoyed core FFO per share growth of 9% in 2021, and it expects a whopping 15.3% growth this year. The latest (likely yet to be updated higher) consensus from analysts calls for another 8% growth

in 2023. That is fantastic growth for a sleepy old apartment REIT.

Moreover, the dividend has plenty of room to be raised at rates around the growth in core FFO per share. The expected payout ratio for 2022 based on AFFO is just below 60%.

Even so, assuming dividend growth equal to core FFO growth going forward, I would still project 10-year forward dividend growth to average around 7% annually, with the highest growth rates front-loaded over the next few years.

Using the Chowder Rule (dividend yield plus dividend growth rate) and targeting at least 10%, we would be required to purchase MAA at a 3% dividend yield. That would imply a buy price of $145 per share. Such a price would value at ~19.9x AFFO and ~17.9x core FFO.

However, I cannot envision a scenario where MAA’s growth rate stays the same and that price is reached, short of a broad and deep stock market selloff. And yet, I still want to buy more of the stock. So at what price should I buy it?

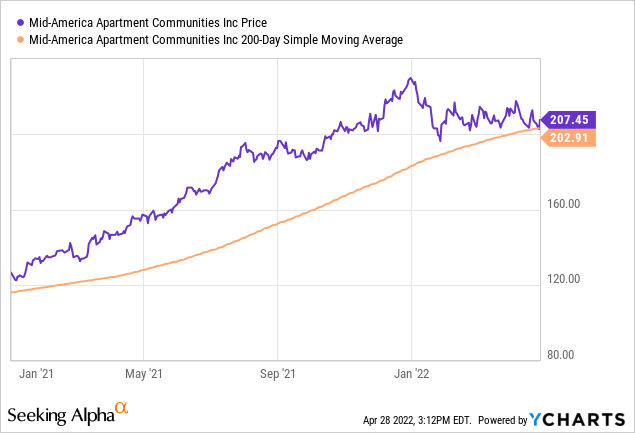

In lieu of a better alternative, I believe the best thing to do is to buy MAA on dips – specifically, as close as possible to the 200-day moving average.

As you can see, MAA’s rangebound stock price has allowed the 200-day moving average to catch up, and now MAA is only 2.2% higher than the SMA.

Technically, then, MAA makes a good buy right now, even though the stock’s attractiveness as a dividend growth play is weak due to the low starting yield of 2.1%.