Housing Costs Jump in Florida, Texas Thanks to the Pandemic

This is Bloomberg Opinion Today, a pleasant, mid-sized city of Bloomberg Opinion’s opinions. Sign up here.

Today’s Agenda

We Hear Pittsburgh Is Nice This Time of Year

The problem with living in beautiful or job-filled places is that everybody else naturally wants to live there, too. And the people who were already there get annoyed by all the new people and make it harder to build houses for them, so housing costs soar.

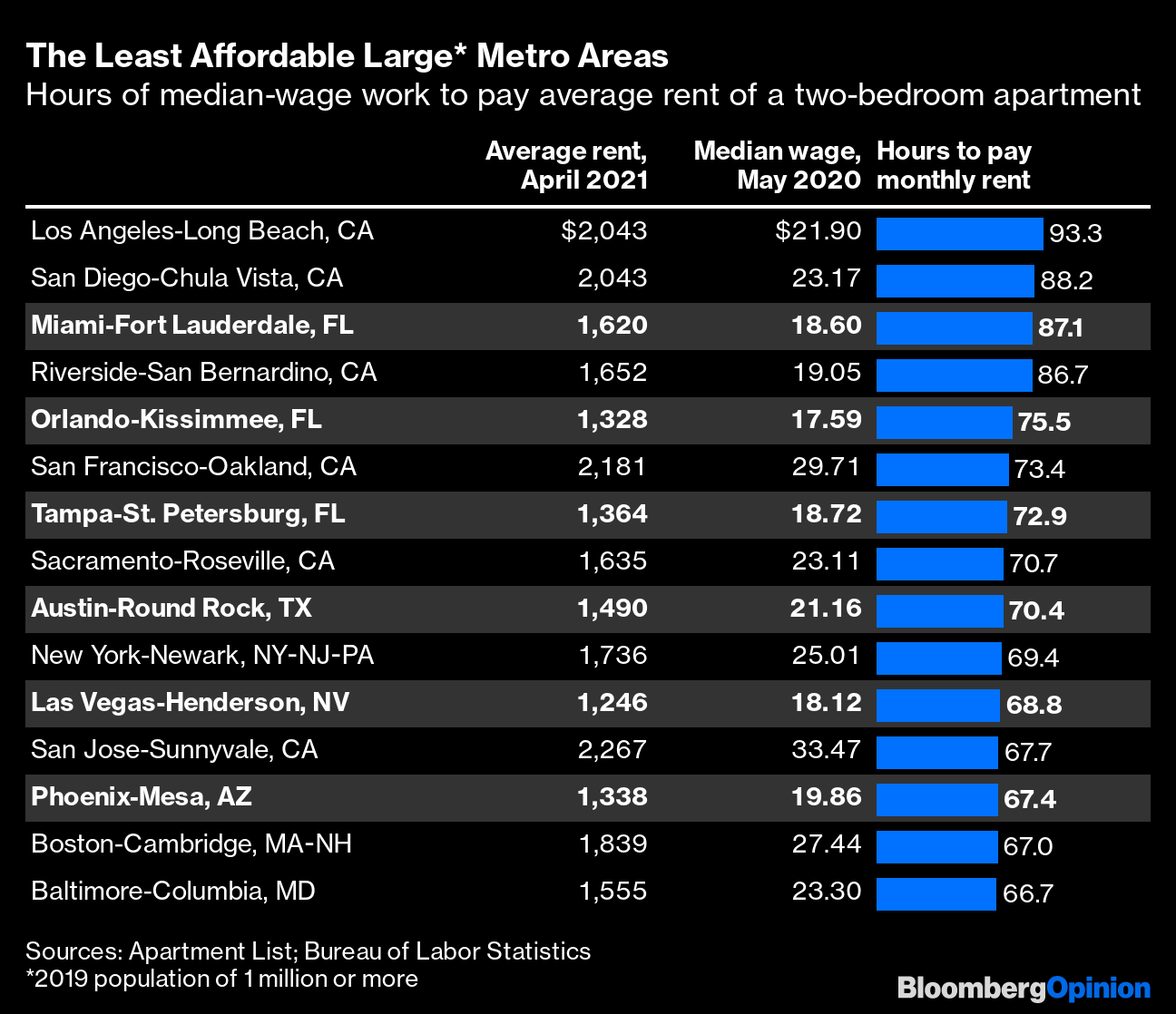

This has been a problem forever for well-known desirable places, such as New Jersey. But now it’s becoming a problem for less-well-known places, too, writes Justin Fox. Boise, Idaho, for example, may not spring to mind when one thinks of desirable locales lousy with NIMBYism. But it’s fast becoming one of the priciest places for normal humans to live. And by chasing workers from high-priced cities to slightly lower-priced retreats, the pandemic has skewed housing affordability in several places you might not expect:

The Least Affordable Large* Metro Areas

Hours of median-wage work to pay average rent of a two-bedroom apartment

Sources: Apartment List; Bureau of Labor Statistics

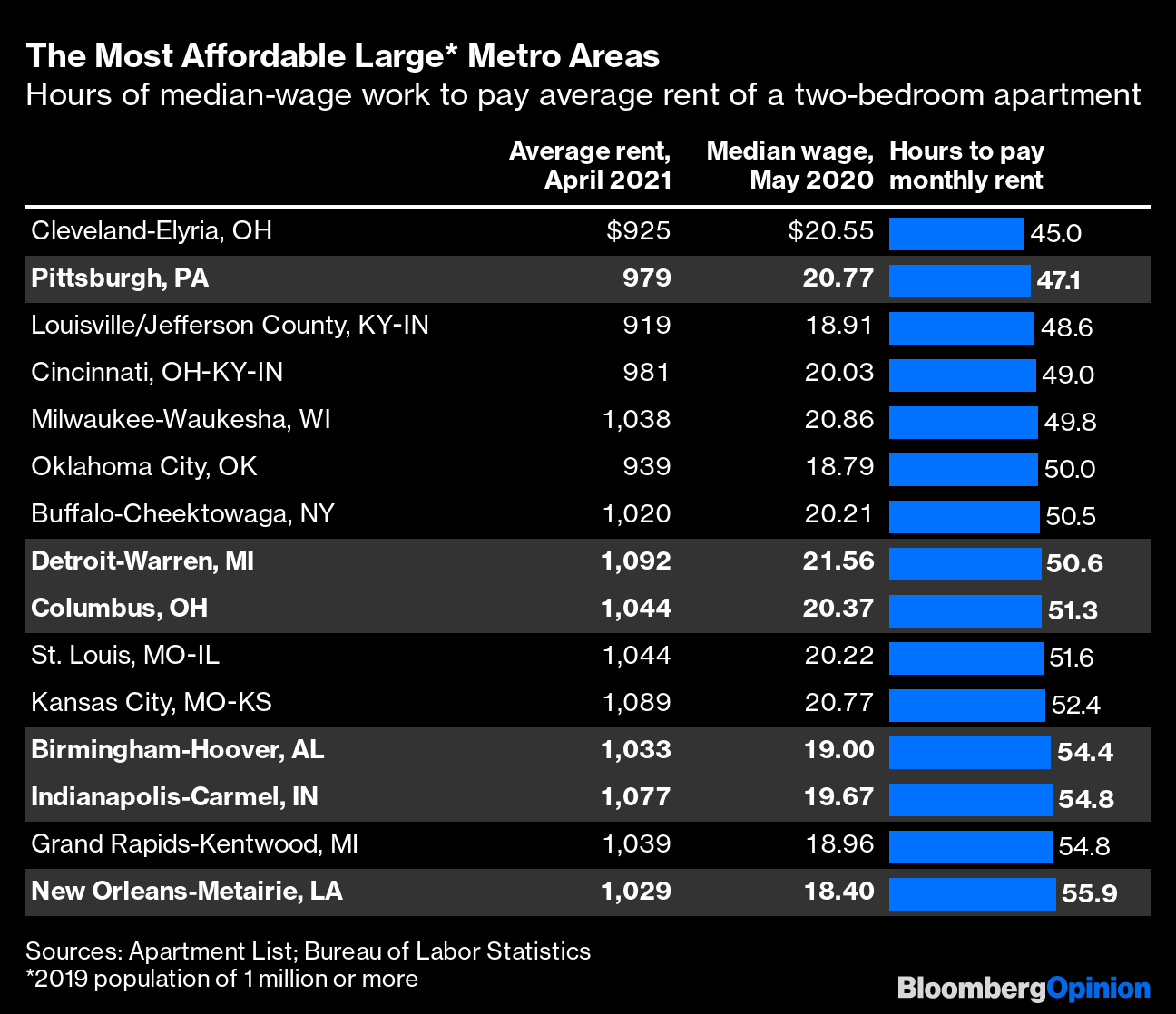

Now, if you can transport your full, let’s say, Boston salary to, let’s say, Phoenix, then you’ll be doing OK. If not, then you’ll be slightly worse off, housing-wise, though the weather will be nicer. Because inside Justin beats the heart of a kindly Realtor, he also dug up the cheapest places to live. They’re no Boise, but they’re also pretty nice places, a lot of them:

The Most Affordable Large* Metro Areas

Hours of median-wage work to pay average rent of a two-bedroom apartment

Sources: Apartment List; Bureau of Labor Statistics

He also has tables of the smaller metro areas, the cheapest of which is Odessa, Texas. It has no mountains or beach, but it does have a Stonehenge replica, where you and the family can pass the time re-enacting this scene. Read the whole thing.

Bonus New-World-of-Work Reading: Surging demand plus a labor shortage should equal better pay and benefits for Uber and Lyft drivers. — Tae Kim

The Seven Habits of Happily Undercompensated Fund Managers

Or you could live in Norway, often called the Boise of Europe. But you might struggle to land one of the most desirable jobs in that country: helping to manage its sovereign wealth fund, the world’s biggest. You might think that gig would be all too easy to get, as Norway’s government can’t compete on bonuses with private firms. But in fact its managers are happy and tend to stick around for a long time, writes Mark Gilbert. Maybe that’s because they get things some people consider more important than money, things like freedom and power and a break room stocked with pickled herring.

Back in Leola, Pennsylvania, the manager of the $4.7 billion Emerald Advisers fund has courted controversy by exercising maybe a smidgen too much freedom, notes Brian Chappatta. Ken Mertz has gambled a piece of a highly rated banking and finance fund on crypto, causing Morningstar to whack it with the Downgrade Stick very sternly indeed. One could argue, as Mertz does, that crypto is basically “finance.” One could also sleep well at night on a bed of money produced by the kajillion-percent performance of the fund lately. But it could be the first, happy part of a sad cautionary tale about the siren song of meme investments. At least he’s not big into Dogecoin.

Further Fund-Trends Reading: Japan’s government pension fund, the world’s biggest, has curbed its enthusiasm for ESG after disappointing returns. — Shuli Ren

Biden to Soak the Rich After Giving Them Huge Poncho

You can’t swing a dead cat at the yacht club these days without hitting somebody complaining about President Joe Biden raising taxes on the wealthy to pay for his schemes. What you don’t hear about so much is how Biden’s tax plan would leave in place a massive loophole Republicans built for them back in 2017, writes Alexis Leondis. This is called the “pass-through” deduction, as in “please feel free to pass your money safely through this loophole,” and it may cost the government at least $175 billion a year.

Further Biden-Plan-Problem Reading: Subsidizing college won’t help students. Boosting Pell grants will. — Naomi Schaefer Riley

Telltale Charts

Your supply-chain nightmares are a dream come true for shipping, storage and delivery companies, writes Chris Bryant.

Pandemic Winners

Logistics giants are cashing in on supply chain bottlenecks

Source: Bloomberg

Further Reading

The real global flashpoint is the Black Sea, where Russia will likely try to dominate Ukraine’s navy, putting NATO in a bind. — James Stavridis

Britain and France won’t go to war over fishing rights, but expect regular disputes over such details in the Brexit era. — Therese Raphael

Indian stocks aren’t priced for the pandemic’s grim reality. — Andy Mukherjee

Liz Cheney’s stance is admirable but probably won’t change the GOP. — Jonathan Bernstein

Elizabeth Holmes may plead puffery as a defense. But courts tend to frown on this, with good reason. — Stephen Carter

Thanks to the commercial space industry, routine space tourism is closer to reality. — Stephen Mihm

ICYMI

Angela Merkel isn’t on board with waiving vaccine patents.

Biden might carry out his predecessor’s China investment ban.

Trading cards are getting a reality show.

Kickers

Culinary geniuses create flat pasta that turns into shapes when boiled.

Bottle of wine from the ISS could auction for $1 million. (h/t Ellen Kominers for the first two kickers)

Area 4-year-old accidentally buys $2,600 worth of SpongeBob popsicles on Amazon. (h/t Scott Kominers)

New clouds just dropped.

Notes: Please send SpongeBob popsicles and complaints to Mark Gongloff at [email protected].

Sign up here and follow us on Twitter and Facebook.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

To contact the editor responsible for this story:

Brooke Sample at [email protected]