Californians: Here’s Why Your Housing Costs Are So High

Tenants and landlords are hurting, homelessness is skyrocketing

and the housing market is out of control. The COVID-19 pandemic

isn’t the only reason for that, but it’s making California’s

longstanding housing crisis even worse.

In 2021, nine out of ten Californians consider housing

affordability a problem, and nearly one in three Californians are

considering leaving the state because of it, according to

a March

survey by the Public Policy Institute of California.

So how did things get so bad? Here’s what you need to know about

California’s housing costs.

Just how hard is it to buy a home in California?

Hard. Really hard. Both compared to how difficult it is in other

states, and how challenging it was for previous generations of

Californians.

In the late 1960s, the average California home cost about three

times the average household’s income. Today, it costs more

than seven

times what the average household makes.

While it’s always been more expensive to be a homeowner in

California, the gap with the rest of the country has grown into a

chasm. The median California home is priced nearly 2.5 times

higher than the median national home, according

to 2019 Census data.

The pandemic hasn’t cooled the housing market, either. Demand has

long exceeded supply of homes for sale in California, and that’s

especially true now. But while many families are suffering the

economic impacts of COVID-19, wealthier households with money to

spend and capitalizing on low interest rates have driven up

prices even more. In September 2020, California’s median

home price reached $712,430 — a historic high.

Who owns their house?

Despite relatively low mortgage rates, however, exploding housing

prices have caused California’s overall homeownership rate to dip

significantly. Just more than half of the state’s households own

their homes — the third lowest rate in the country and the lowest

rate within the state since World War II.

And those homeowners skew significantly white. White Californians

are twice as likely as Black Californians to own their

home, according to

2019 Census data. The racial gap in homeownership has widened

over the years, which also means Black Californians are less

likely to build wealth over time, said Carolina Reid, associate

professor of city and regional planning at UC Berkeley.

But racial disparities are true in all dimensions of housing.

“Blacks and Hispanics are more likely to be cost burdened, more

likely to live in overcrowded conditions, more at risk of

eviction, and displacement,” she said.

Rents dipped with the pandemic, but are still soaring

Rents are among the highest in the country in California, home to

seven of the ten most expensive cities for tenants. The pandemic

has changed things up — driving down rents in some of the most

expensive cities and hiking rents in some more affordable ones.

But affordability overall has only worsened with COVID-19.

San Francisco remains the most expensive city to rent in the

United States, with the average rent for a two-bedroom apartment

at $3,500 a month, according to Zillow. That’s even after a 23%

drop from last year. Fresno, at one point considered on the more

affordable end of California housing, has seen a 39%

hike in average rent since 2017, including a 12% increase during

the pandemic.

The drop in homeownership plays a role here. As it has become

more difficult to buy a home, wealthier people have remained

stuck in the rental market — and driven up rent prices.

Wages can’t keep up with rental costs

Median earnings for Californians are higher than the national

average, and are significantly higher in certain regions like the

Bay Area. But on average, income over the past two decades has

not kept pace with escalating rents.

Before the pandemic, about half of California renters were rent

burdened, which means that more than 30% of their income went

toward rent, according to the

Harvard Joint Center for Housing Studies. Nearly a third of

Californians were severely rent-burdened, which means that more

than half of their income went toward rent.

The numbers are worse for families of color. A California

Housing Partnership analysis found that in 2019, Black

renter households were about twice as likely as white renter

households to be severely cost burdened.

The pandemic only worsened these numbers. As unemployment

skyrocketed and families lost wages, roughly one of every six

tenants fell behind on rent payments, according

to a study by the Little Hoover Commission.

It’s a statewide problem

The extremes of California’s housing crisis are concentrated in

the Bay Area and greater Los Angeles, but the challenge is

statewide. While San Diego, San Francisco and L.A. top the list

of toughest rental markets in the country, cities including

Sacramento and Fresno recently have experienced the largest

year-over-year rent increases.

In most Central Valley cities, the majority of very low-income

families are spending more than 30% of their paycheck on rent.

Homelessness is on the rise

The number of people experiencing homelessness is notoriously

hard to track, but estimates are getting more accurate — and show

that the problem is big, and worsening.

Newly released state numbers show that throughout 2020, nearly

a quarter of a million people accessed homeless

services through local agencies. About 160,000 were

single adults, and nearly 85,000 in families with kids. Los

Angeles County has the highest number of people experiencing

homelessness, with about 90,000 people who accessed services in

2020.

That data — submitted by 42 of the 44 local agencies that manage

homeless dollars and services across the state — was not

previously compiled or made public. That number is dynamic,

because someone may have been homeless at the start of the year,

but housed by the end — or vice versa.

The data also fails to count some individuals who never

interacted with homeless providers and survivors of domestic

violence who are omitted for safety purposes, according to Ali

Sutton, the state deputy secretary for homelessness.

According to the state, nearly 40% of those people, or 91,626

individuals, moved into permanent housing last year — which could

mean anything from moving back in with a family member to getting

their own place. This overlaps with an unprecedented amount of

funding going to fix the issue — $13

billion over the last three years.

Previous estimates of people experiencing homelessness were much

lower. Every two years, the federal government mandates a tally

of the number of people on the streets on a single night in

January. Advocates and experts have long clamored that the count

is not

accurate.

The point-in-time count was last taken in January 2020 — before

COVID-19 ravaged the economy — and showed 161,548 people

experienced homelessness in California. The January 2021 count

was postponed due to COVID-19.

It’s really hard to pass legislation to build more housing in

California

Sen. Scott Wiener takes a photo of the vote tally as the eviction

bill passes in the senate. (Photo by Anne Wernikoff for

CalMatters)

But that doesn’t stop lawmakers from trying, and trying again.

2020 was supposed to be a big year for housing legislation.

Lawmakers proposed a slew of housing bills, including a measure

that would have forced cities to allow more mid-rise apartment

buildings, convert big-box retail property into housing, and

limit the restraints of environmental law on housing projects.

None of those bills passed. Democratic

squabbling and the global pandemic, among other factors, were

to blame.

Key legislators are back

at it this year. The bills are mostly designed at easing

zoning and environmental restrictions to allow for more dense

housing, funneling more money into affordable housing production

and trying to force local governments to comply with state

goals.

Here are a just a few of the bills we’re watching this year:

AB 215, by Assemblymember David Chiu, would essentially give

teeth to the Regional Housing Needs Allocation, a law designed to

increase housing production but that has done little to mandate

it. Cities would need to check in with the state halfway through

their eight-year housing approval process. If they’re behind on

their goals, the state would force them to approve more

pro-housing policies.

SB 9, by Senate leader Toni Atkins of San Diego, bears

some resemblance to last year’s SB 50. The bill would allow

homeowners to put a duplex on single-family lots or split them

without requiring a hearing or approval from the local

government. Affordable housing and rental properties would be

exempt from the changes.

SB 10, by Sen. Scott Wiener, would allow cities to rezone

transit centers and job hubs to allow as many as 10 units per

parcel. Proximity to public transit would theoretically lead to

fewer cars on the road, bringing the state closer to its goals to

reduce climate change.

SB 478, also by Wiener, takes aim at local ordinances that

limit the construction of housing based on lot size, which

effectively erases any chance of building small apartment

buildings on land that is already zoned for multi-family

housing.

California’s most controversial homebuilding bill

Senate Bill 50, proposed last year by Sen. Scott Wiener, would

have forced cities to allow more mid-rise apartment buildings

around public transit and next to some single-family homes.

Proponents believe this is the best and quickest way to come

close to meeting the state’s housing needs.

A host of political interests supported the bill — developers,

landlords, environmental groups, big city mayors and even

Facebook wanted

to see it pass. But the bill failed to get enough votes in

the Legislature to survive in

2020 before time ran out. Among the opponents were Los Angeles

Democrats, spurred by low-income tenant advocacy groups.

That wasn’t the first time the legislation failed.

Similar versions of the bill had been blocked twice before, with

strong opposition from suburban homeowners, local governments and

community groups who contended the proposal would destroy

neighborhood character and gentrify lower-income communities.

“As disappointing as it was not to pass (Senate

Bill 50), it left me quite optimistic about what we will be

able to do in the future,” Wiener told

CalMatters. “The fact that a bill four or five years before

(SB 50) would not have probably even gotten a hearing in a single

committee, but then we were able to get it through two committees

and almost off the Senate floor (means) there is actually very,

very broad and deep support for a pro-housing agenda.”

Many of the same ideas proposed in SB 50 will be up for debate

again this year.

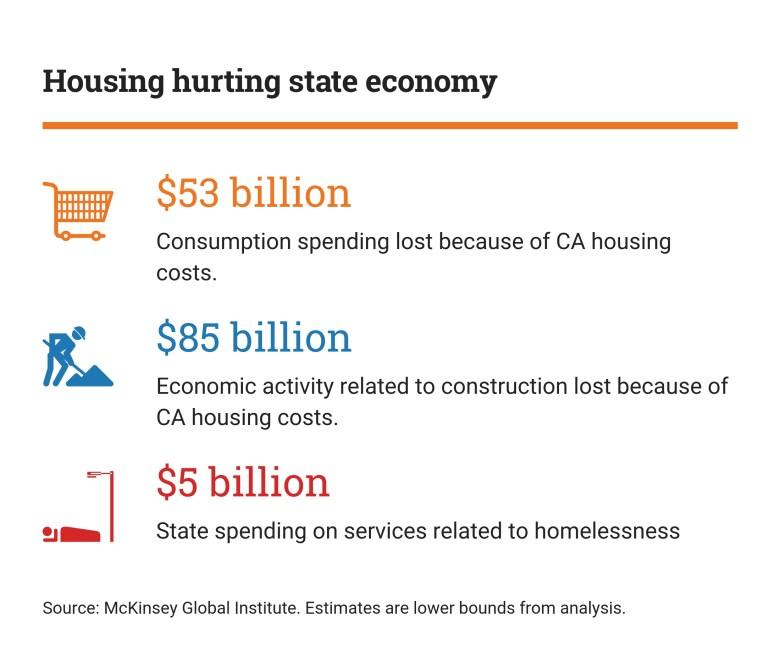

The housing crisis has major repercussions for the economy

Big business is also feeling the pinch of California’s housing

crisis.

The McKinsey Global Institute found that housing shortages

cost the economy between $143 billion and $233 billion annually,

not taking into account second-order costs to health, education

and the environment. Much of that is due to households spending

too much of their incomes on the rent or mortgage and not enough

on consumer goods.

Even the attractive salaries and lavish perks of Silicon Valley

struggle to overcome the local housing market, as young tech

talent flees to

the relatively inexpensive climes of Austin or Portland. Nearly

60 percent of Los Angeles companies in a recent University of

Southern California survey said the region’s high cost of living

was affecting employee retention.

Bad news, California: People like to live in houses

California just doesn’t have enough housing to keep up with

demand.

Over the past 10 years, California’s population grew by about

6.7%, while new housing grew by only 4.8%, according

to data from the California Department of Finance.

Population growth has slowed down significantly. In 2019, the

state for the first time added more housing units than people.

But the picture might be less rosy than the numbers suggest.

A lot of people are still coming to California, but many of those

leaving are likely being priced out, according to Department of

Finance research data specialist John Boyne.

“I’m sure housing is a pretty major factor,” he said.

Unlike at the start of the decade, when California was on a

single-family homebuilding binge, the recent increase in housing

production consists mainly of multi-family housing and accessory

dwelling units in the downtown areas of Los Angeles, San

Francisco and San Diego, Boyne said.

That doesn’t mean they’re more affordable: Only 7% to 10% of the

new units are designated as affordable, Boyne said.

Building new homes is an expensive business…especially in

California

Part of the problem boils down to the (literal) nuts and bolts of

housing development. Over the last decade, the cost of building

multifamily housing in California has spiked by about 25%,

according to a 2020

report by the Terner Center for Housing Innovation at UC

Berkeley.

On average, each square foot cost $44 more to build in 2018 than

it did a decade ago across the state. In the Bay Area, however,

that cost jumped up by $81 a square foot, according to the Terner

Center. And affordable housing was more expensive to build than

market rate housing.

The reasons are many and complicated, but two big ones are more

expensive materials and a shortage of labor. While permitted

units spiked by 430% between 2009 and 2018, the number of workers

has grown by only 32%. Experts attribute the lack of construction

labor to anti-immigration rhetoric, a tighter overall labor

market and depressed wages.

The California land rush

But construction costs are only part of the problem. And

sometimes a relatively small part at that.

In most of the state’s major urban areas, the bulk of a

single-family house’s price is locked into the land it sits on.

That high price tag on the cost of actually buying a parcel and

prepping it for construction not only makes new housing more

expensive, it influences what kind of housing gets produced:

developers prioritize high-end projects, since even the

cheapest pre-fab unit will come stuck with a steep fixed cost.

What makes land expensive? When it’s in shortest supply. Take San

Francisco: Seven-by-seven miles of hillside penned in by water on

three sides. Of the top 15 most physically constrained metro

areas in the country, seven dot

California’s oh-so-desirable coast. But many of those same

coveted locales place additional limits on where—and when and how

and how much—construction can take place. That all makes it that

much harder for housing to keep up with population growth. And

over the last decade, it has not.

*An earlier version incorrectly referred to the structural

value of single-family homes as construction costs.

If not in your backyard, then whose?

Who has cause to celebrate when a new housing project goes up in

your neighborhood? Young homebuyers, nearby businesses, new

arrivals to the area, and, of course, developers. But people who

have been living in the neighborhood for years may worry that the

new development will depress the value of the homes they own, or

trigger increases in the rent they pay. Those who prefer not to

live next door to a construction site, or watch

their zucchini garden

wither in the shadow of a garish new condo building, have plenty

of reasons to object.

And object they do. With the exception of one irregularly

enforced state law,

land use planning in California is a local process—and one that

affords opponents of change ample opportunity to stall, stymie,

or scale down. The tool kit of local obstruction includes zoning

restrictions, lengthy project design reviews, the California

Environmental Quality Act, parking and other amenity

requirements, and multi-hurdled approval processes. In

California, you’re most likely to find these extra restrictions

where developable space is already scarcest —

in coastal urban enclaves.

Local pushback might be rooted in concerns about the environment,

about congestion, about the creep of gentrification, or in a

desire to preserve the “character” of the neighborhood (however

that might be defined). But whatever the flavor of NIMBYism and

whatever its ultimate goals, higher hurdles to development in the

state’s most desirable locations mean many cities have failed to

add new units fast enough to keep up with population or job

growth.

And that inevitably means higher prices.

A lack of public dollars

A little recent history: In 2012, California began unwinding its

redevelopment agencies, the local investment organizations tasked

with revitalizing “blighted” areas across the state. By law,

redevelopment agencies were supposed to provide a guaranteed

stream of cash to cities for subsidized housing — 20% of any

increase in property tax payments.

Much — in many cities, most — of that money didn’t end up going

into the construction of new housing, but was instead siphoned

off to pay for broadly defined “administrative activities.”

Still, with the end of redevelopment came the end of the single

largest source of non-federal money for affordable housing in the

state. California lawmakers never plugged that hole.

Between 2013 and 2018, state investments in affordable housing

dropped from an annual average of $1.3 billion to less than $500

million, according

to the California Housing Partnership.

The state began reversing that trend in 2019, thanks to funding

from SB 2, which dedicated about

$250 million in annual revenues for affordable housing;

about $5 billion worth of housing bonds from Proposition 1 and 2;

and $500 million in state low-income

housing tax credits.

But the new dollars will dry up by 2022, leaving developers

without a stable funding source, said California Housing

Partnership CEO Matt Schwartz.

“Politically you can understand the attraction,” Schwartz said.

“At a mechanical, functional level, it creates huge amounts of

extra work particularly for the nonprofit housers we assist.”

Getting around the NIMBYs

It’s hard to get people to agree on a solution when they don’t

even agree on the problem.

Ask some politicians and much of the blame for California’s

housing woes lies with local obstructionists. Take away the

NIMBYs’ favorite procedural tools and the housing market will

eventually build its way out of the shortage. President Biden, in

his $2 trillion infrastructure plan, says

that restrictions on multi-family zoning “drive up the

cost of construction and keep families from moving to

neighborhoods with more opportunities.”

But red tape has a powerful constituency. Its members include:

-

City governments, which generally like having a say in

what does and doesn’t get built within their borders. The

powerful League of California Cities has opposed several

measures to streamline the local housing approval process. It

has called such efforts counter to the “the principles of

local democracy and public engagement.” -

Environmentalists, who don’t want the Legislature

tinkering with California Environmental Quality Act (CEQA).

Pro-housing advocates argue that environmental concerns can be

used as a pretext to hold up a project for any number of

unrelated reasons. Cases in point: The law has been used in the

past to block high-density housing and bike

lanes. According to the Legislative Analyst’s Office, CEQA

appeals delay a project by an average of two-and-a-half

years. -

Building trade groups also benefit from the

status quo. Any developer that uses public funds (in other

words, anyone building affordable housing) is required to pay

workers the most common rate for that job across the region.

That “prevailing wage” tends to be set by the union rate. Labor

groups have lobbied lawmakers to make prevailing wage

restrictions a part of any housing fix. How much more expensive

do union-level wages make housing projects? Experts differ with

estimated cost increases ranging from 0 to 46 percent. -

Anti-gentrification activists, who often argue

that developers should be saddled with more restrictions, not

fewer. New houses may bring down prices over time,

they argue, but for those who are facing eviction or

displacement today, new, high-end development only makes a

particular locale more attractive to outside investors and

wealthy house hunters. -

Good old fashioned NIMBYs. In 2017, Marin County got a

special exemption from the state’s housing development

quota. What was the justification? According to one

county supervisor,

ramping up affordable housing construction wasn’t consistent

with Marin’s “suburban character.”

What about Prop. 13?

You’d be hard pressed to find a single aspect of California life

that isn’t affected by Proposition 13. Naturally, it gets blamed

for an awful lot of the state’s problems.

So what about the cost of housing? After all, Prop. 13,

California’s 1978 tax revolt initiative, capped property taxes at

1 percent of a home’s purchase price and limited the rate taxes

can tick up each year by 2 percent. From a city’s perspective,

giving your available land to new housing doesn’t make much sense

if a sales-tax-paying restaurant or clothing store is waiting in

the wings.

The Legislative Analyst’s Office looked into

the question of whether the state’s capped property taxes distort

local land use decisions. Their conclusion: a resounding

“probably not.” In short, a city’s dependence on property taxes

or sales taxes didn’t predict much about its land use decisions.

Even so, there are other ways in which Prop. 13 could be

contributing to our affordability crisis. Another consequence of

capped property taxes is that local governments have to scramble

for other sources of cash. One of those sources is housing

developers. On average, California levies the highest developer

fees in the country, making it that much more difficult to build

new housing.

CalMatters.org is a

nonprofit, nonpartisan media venture explaining California

policies and politics.

–

Stay up to date on the effects of the coronavirus on

people and business in the Capital Region: Subscribe to the Comstock’s newsletter

today.