America’s Climate-Change-Prone Areas Are Seeing Their Populations Swell

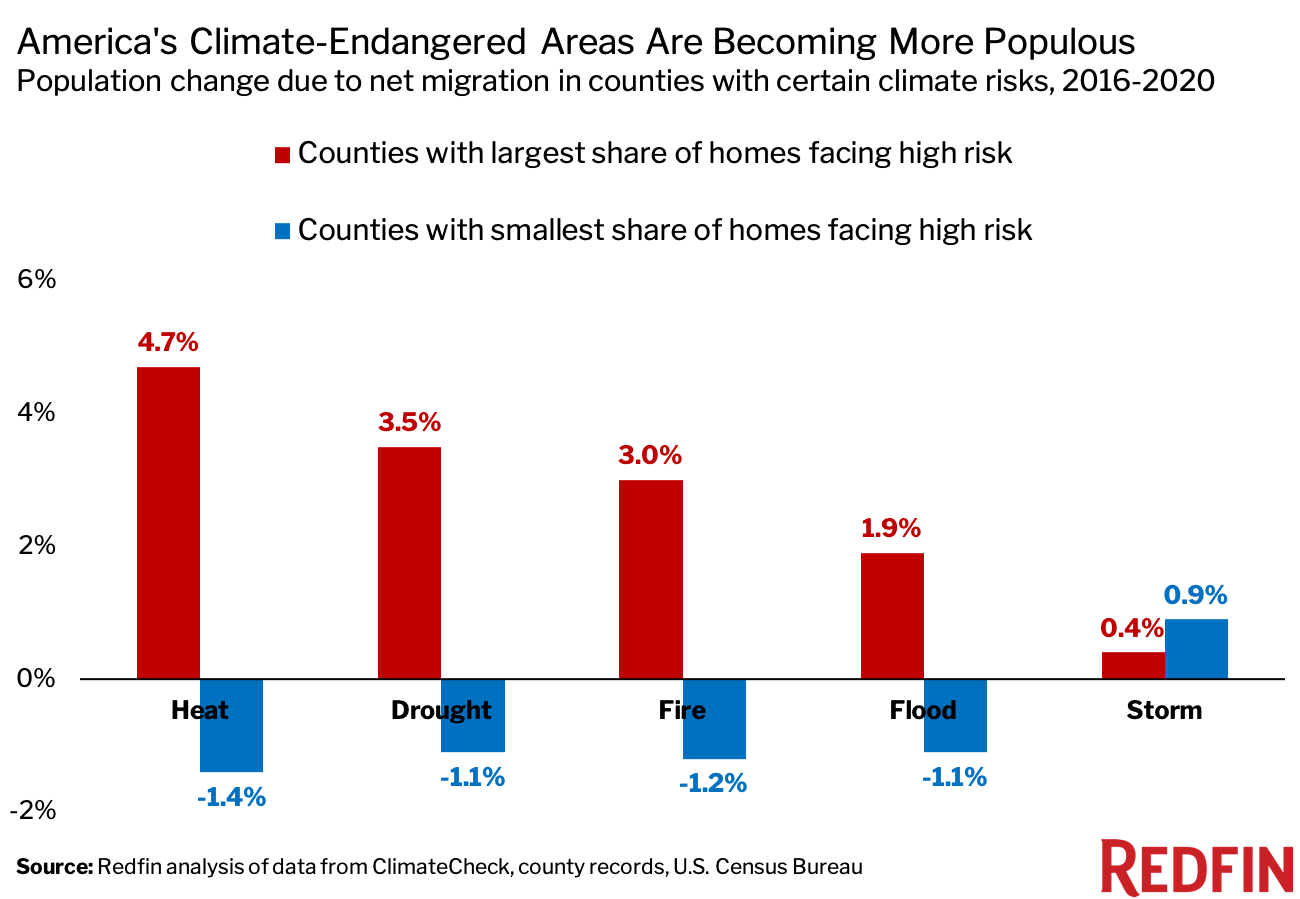

- The U.S. counties with the largest share of homes facing high heat, drought, fire, flood and storm risk saw their populations grow from 2016-2020 due to migration.

- The counties with the smallest share of homes facing climate risk largely saw their populations decline.

- Relative affordability may be playing a role: Counties where many homes face high heat risk are less expensive on average than counties where few homes face high heat risk.

America’s disaster-prone areas are becoming more populous as new residents move in, according to a new Redfin analysis.

The 50 U.S. counties with the largest share of homes facing high heat risk saw their populations increase by an average of 4.7% from 2016 through 2020 due to positive net migration. Meanwhile, the 50 counties with the largest percentage of homes facing high drought, fire, flood and storm risk experienced average population growth of 3.5%, 3%, 1.9% and 0.4%, respectively, due to positive net migration.

Positive net migration means more people moved in than out, while negative net migration means more people moved out than in. The term “migration” includes both domestic and international migrants, and should not be confused with “immigration,” which refers only to people moving in from a different country.

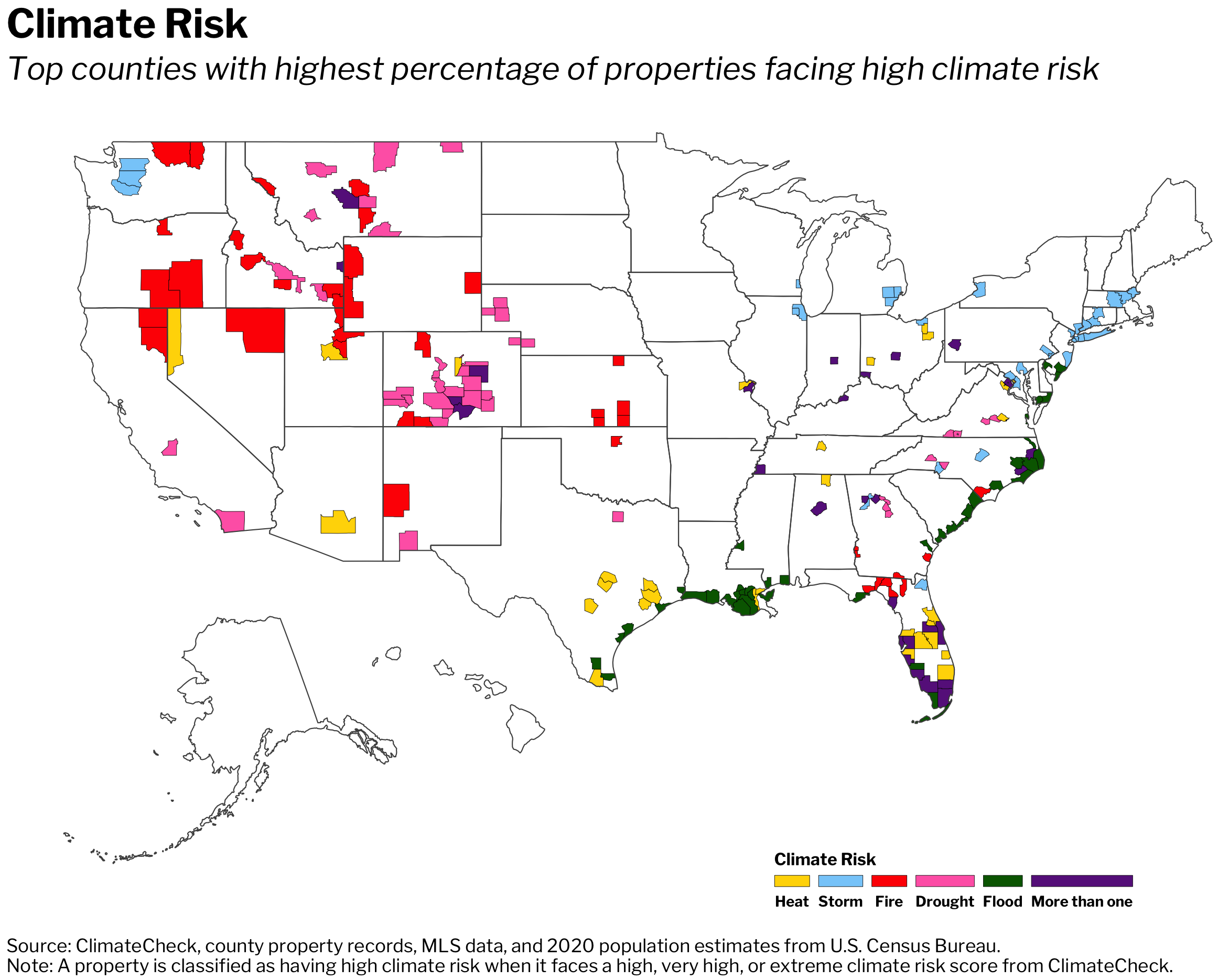

This is according to a Redfin analysis of data from climate-data startup ClimateCheck, county property records and the U.S. Census Bureau. For each climate-change risk—heat, drought, fire, flood and storm—we analyzed the 50 U.S. counties with the greatest share of homes facing high risk and the 50 counties with the lowest share of homes facing high risk. Counties must have had at least 500 homes as of Aug. 2, 2021 to be included in this analysis.

Places with relatively low climate risk have experienced the opposite trend: population decline. The 50 counties with the lowest share of homes facing high heat risk saw their populations decrease by an average of 1.4% from 2016 through 2020 due to negative net migration. Meanwhile, the 50 counties with the smallest percentage of homes facing high drought, fire and flood risk experienced average migration-driven population declines of 1.1%, 1.2% and 1.1%, respectively. Bucking the trend were the 50 counties with the lowest share of homes facing high storm risk, which experienced 0.9% population growth.

“People have been gravitating to places with severe climate risk because many of these areas are relatively affordable, have lower property taxes, more housing options or access to nature,” said Redfin Economist Sebastian Sandoval-Olascoaga. “For a lot of people, these benefits seem to outweigh the dangers of climate change. But as natural disasters become more frequent, homeowners in these areas may end up losing property value or face considerable difficulty getting their properties insured against environmental disasters.”

Of the 50 counties with the largest share of properties facing high heat risk, 40 had median sale prices below the national level ($315,000) in 2020. Of the 50 counties with the largest share of properties facing high storm risk, 30 had median sale prices below the national level last year. Data on relative affordability in counties with high fire, drought and flood risk is unavailable due to insufficient sale-price data in many of the counties.

Population growth in areas endangered by climate change has coincided with intensifying natural disasters across the country. There were 104 large, active wildfires burning in the U.S. as of Aug. 19, triggering evacuation orders for thousands of residents. Smoke from the West has spread as far as New York City. In California, the Dixie Fire has destroyed more than 650,000 acres, becoming the second-largest fire in the state’s history. It was only 35% contained as of Aug. 19. Nearly the entire West is grappling with drought, and record-breaking heat waves across the U.S. and Canada killed hundreds of people this summer. Atlantic hurricane season is also shaping up to be worse than expected.

“It is unequivocal that human influence has warmed the atmosphere, ocean and land,” scientists wrote in a groundbreaking United Nations report this month. “Many changes due to past and future greenhouse gas emissions are irreversible for centuries to millennia.”

Fortunately, there is still a window of opportunity to prevent climate change from intensifying further, and awareness is on the rise. A February Redfin survey found that the increasing frequency or intensity of natural disasters was a consideration for almost half of respondents who planned to move in the next year. Redfin now publishes climate-risk data for every location page on its website to help house hunters make more informed decisions.

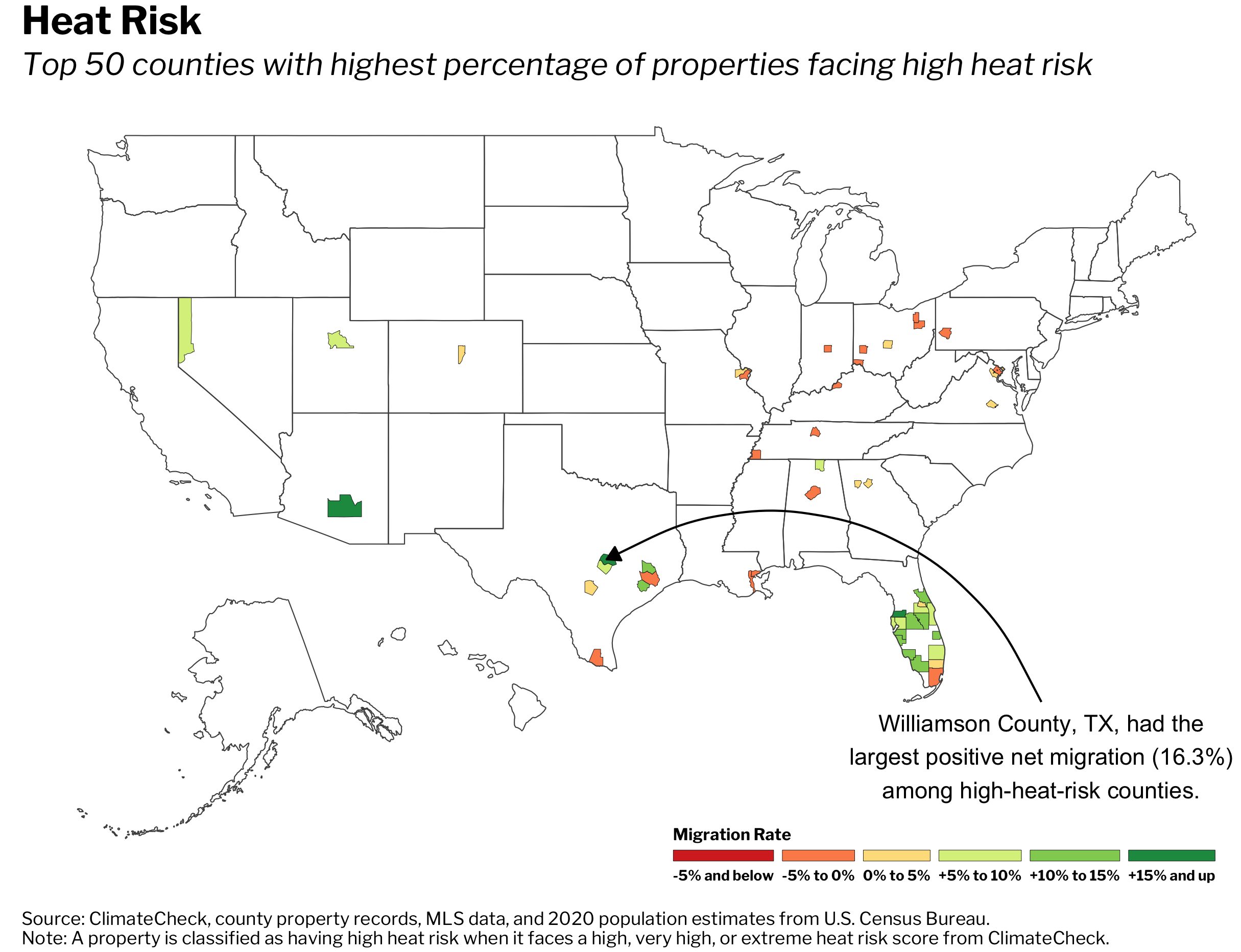

Climate Migration: Counties With High Heat Risk

Heat risk is based on the number of extremely hot days expected in the future. Of the 50 U.S. counties with the highest share of properties facing high heat risk, 37 are in the South, with one-third (17) in Florida alone. More than half (33) of those 50 counties experienced positive net migration over the last five years.

Williamson County, TX—part of the Austin metro area where every home faces high heat risk—saw its population grow 16.3% due to positive net migration from 2016 through 2020. That’s the highest growth rate of the 50 counties Redfin analyzed. It was followed by Pinal County, AZ (just south of Phoenix), which had a positive net migration rate of 15.5%. Rounding out the top five were three Florida counties: Pasco County (15.4%), Osceola County (14.6%) and Manatee County (13.5%).

Migration to places with high heat risk has accelerated over time: All but one of the top five counties saw their net migration rates increase from the prior five-year period—2011 through 2015. The largest jump was in Pinal County, where the rate jumped from 4.1% (2011 through 2015) to 15.5% (2016 through 2020).

Top Five High-Heat-Risk Counties By 2016-2020 Net Migration Rate

| Net Migration Rate, 2016-2020 | Net Migration Rate, 2011-2015 | Number of Homes With High Heat Risk | Dollar Value of Homes With High Heat Risk | Share of Homes With High Heat Risk | Median Sale Price (2020) | |

| Williamson County, TX | 16.3% | 12.9% | 200,250 | $88,880,025,301 | 100% | $304,295 |

| Pinal County, AZ | 15.5% | 4.1% | 139,891 | $47,279,687,220 | 100% | $258,158 |

| Pasco County, FL | 15.4% | 7% | 194,001 | $52,656,679,700 | 100% | $238,964 |

| Osceola County, FL | 14.6% | 14.6% | 134,856 | $38,981,773,642 | 100% | $260,583 |

| Manatee County, FL | 13.5% | 11.5% | 164,900 | $65,584,816,014 | 100% | $304,175 |

All five of the counties in the table above are part of metropolitan areas that have been surging in popularity among out-of-towners. The Phoenix metro area was the number-one U.S. migration destination in the second quarter of 2021, with 37.5% of Redfin.com home searches coming from outside the metro. Austin was close behind, along with the Tampa and Orlando metros, which include the Florida counties in the table above. Interest in warm, relatively affordable areas—especially in suburbs of large cities—has accelerated during the pandemic.

Williamson County, which includes the northern tip of Austin, has exploded in recent years as major companies have set up shop in the area and developers have built more apartments, entertainment and shopping centers, according to local Redfin real estate agent Barb Cooper. Dell Technologies Inc. is headquartered in Williamson County, and Apple Inc. plans to have 5,000 employees in its new $1 billion Williamson County campus next year. There are also several universities and a new hospital complex located in the area.

“Williamson County includes many of the Austin suburbs that have seen exponential growth as more folks have moved in from outside the area—especially California—in search of more space and relative affordability,” Cooper said. “It used to be really hard to sell a custom home with a pool on an acre of land here, and now those homes are selling like hotcakes because so many people are working remotely and want room for home offices. And if they need to go into their actual office, it’s an easy commute to the tech hub in Northwest Austin.”

Cooper continued: “Homebuyers in Williamson County sometimes ask about utility costs—especially after the major power outage caused by the snowstorm this winter—but they don’t seem too concerned about the heat,” Cooper said. “Part of that may be because you don’t know what you don’t know; if you come from an area that hasn’t experienced significant heat or drought, you might not be aware of the implications for homeowners. For example, when it gets hot and dry here, local authorities often put restrictions on how much water homeowners can use, shut down car washes and only let people water their yards on certain days.”

The weather in Williamson County is actually a lure for some house hunters coming from chillier states or from Northern Texas, which has a more humid climate, Cooper added.

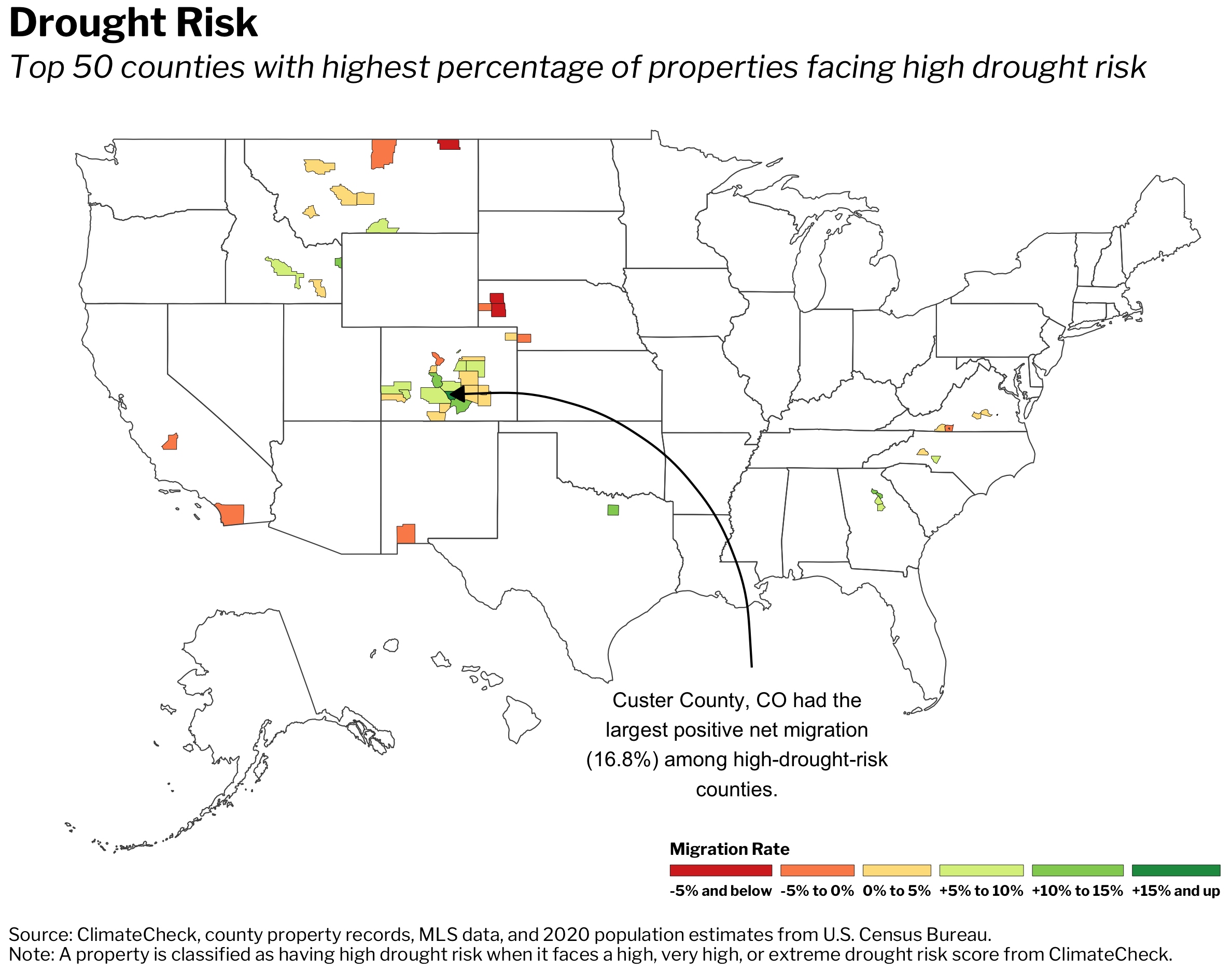

Climate Migration: Counties With High Drought Risk

Drought risk is based on expected water-supply stress, which measures how much of the available water in an area is used by humans. Of the 50 counties with the highest share of properties facing high drought risk, 34 are in the West, with 21 in Colorado alone. More than half (38) of those 50 counties experienced positive net migration over the past five years.

Custer County, CO—a rural area south of Denver where nearly every home faces high heat risk—experienced 16.8% population growth due to positive net migration from 2016 through 2020. That’s the highest growth rate of the 50 counties Redfin analyzed. It was followed by Denton County, TX (north of Dallas), which had a positive net migration rate of 13%. Next came Oconee County, GA (12.6%), Huerfano County, CO (11.9%) and Chaffee County, CO (11.5%). All five counties saw their net migration rates increase from the prior five-year period.

Top Five High-Drought-Risk Counties By 2016-2020 Net Migration Rate

| Net Migration Rate, 2016-2020 | Net Migration Rate, 2011-2015 | Number of Homes With High Drought Risk | Dollar Value of Homes With High Drought Risk | Share of Homes With High Drought Risk | Median Sale Price (2020) | |

| Custer County, CO | 16.8% | 4.8% | 3,869 | N/A* | 100% | N/A† |

| Denton County, TX | 13% | 11% | 259,506 | $107,708,019,969 | 99.9% | $327,620 |

| Oconee County, GA | 12.6% | 6.8% | 13,197 | $5,705,583,741 | 100% | N/A† |

| Huerfano County, CO | 11.9% | -0.2% | 3,597 | N/A* | 100% | N/A† |

| Chaffee County, CO | 11.5% | 5.4% | 7,033 | $3,692,484,404 | 100% | $425,888 |

*Redfin Estimates were not available for given county

†MLS sale-price data was not available for given county

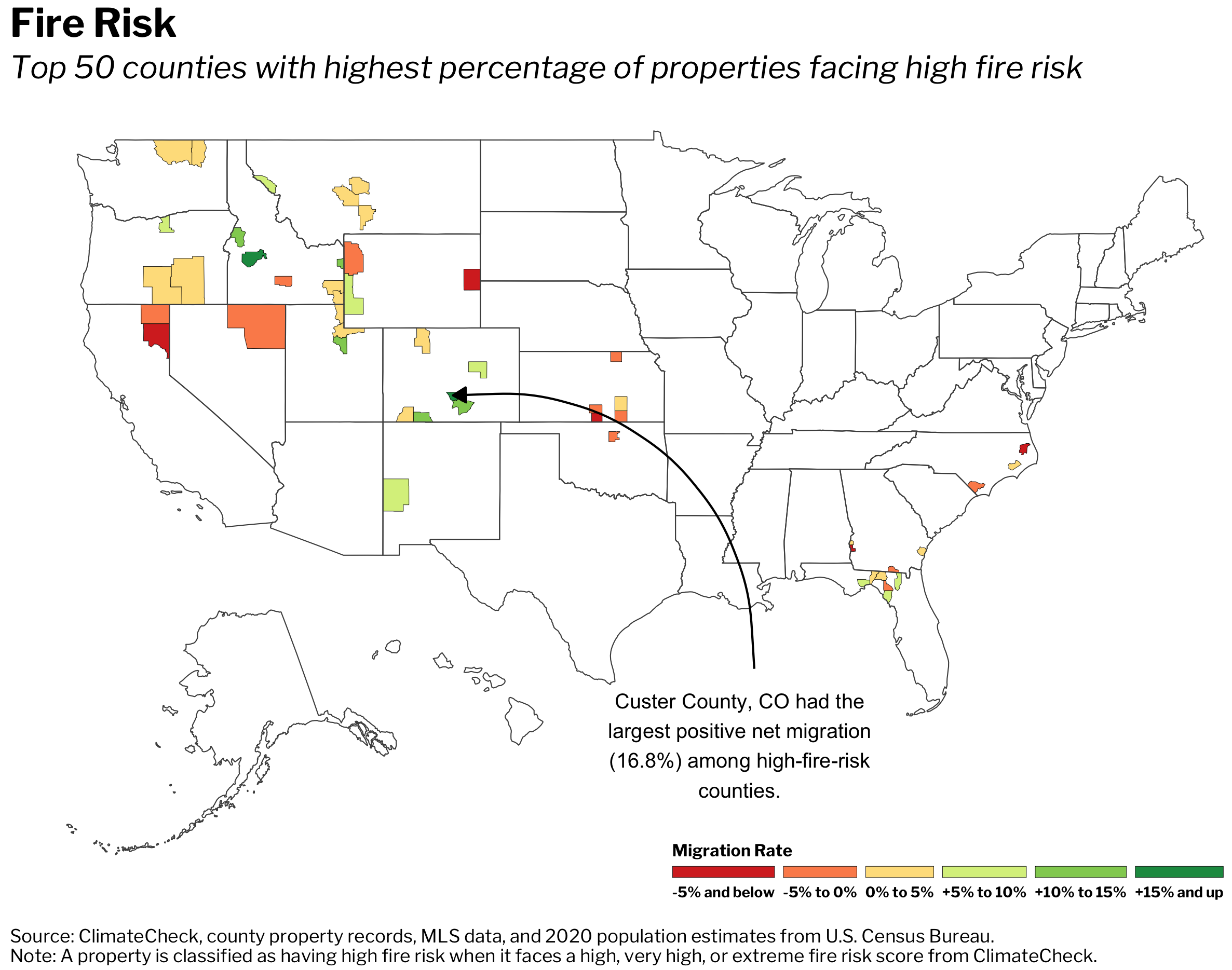

Climate Migration: Counties With High Fire Risk

Fire risk is based on projections of the average share of the area surrounding a home that will burn annually. Of the 50 counties with the highest share of properties facing high fire risk, 31 are in the West. More than half (34) of those 50 counties experienced positive net migration over the past five years.

Custer County, CO experienced 16.8% population growth due to positive net migration from 2016 through 2020—the highest positive net migration rate of the 50 counties Redfin analyzed. It was followed by Boise County, ID, which had a positive net migration rate of 15.2%, and Wasatch County, UT, which is just outside of Salt Lake City and had a positive net migration rate of 14.7%. Rounding out the top five were Adams County, ID (14.2%) and Archuleta County, CO (12.8%). Four of the five counties saw their net migration rates increase from the prior five-year period.

Top Five High-Fire-Risk Counties By 2016-2020 Net Migration Rate

| Net Migration Rate, 2016-2020 | Net Migration Rate, 2011-2015 | Number of Homes With High Fire Risk | Dollar Value of Homes With High Fire Risk | Share of Homes With High Fire Risk | Median Sale Price (2020) | |

| Custer County, CO | 16.8% | 4.8% | 3,702 | N/A* | 95.7% | N/A† |

| Boise County, ID | 15.2% | 0.1% | 917 | $324,381,089 | 98.8% | $355,326 |

| Wasatch County, UT | 14.7% | 15% | 20,376 | $16,796,475,421 | 96% | $648,257 |

| Adams County, ID | 14.2% | -0.9% | 1,193 | $449,525,824 | 96.1% | $343,790 |

| Archuleta County, CO | 12.8% | 1.7% | 7,343 | N/A* | 98.5% | N/A† |

*Redfin Estimates were not available for given county

†MLS sale-price data was not available for given county

Boise County and Wasatch County are rural, mountainous regions outside of Boise and Salt Lake City, respectively. The Boise and Salt Lake City areas have become increasingly popular with out-of-towners in recent years—a trend that accelerated during the pandemic as house hunters sought relative affordability, space and access to the outdoors. More than a third (35.7%) of Redfin.com home searches in the Salt Lake City metropolitan area came from outside of the metro in the first quarter, up from 26.8% a year earlier. Utah, which has a larger share of homes facing high fire risk than any other Western state analyzed by Redfin, has seen its population grow faster than any other state.

“Salt Lake City proper is relatively insulated from fires because it’s located in a valley, but much of the mountainous area surrounding it—especially the Wasatch Range to the east and the north—is covered with dry vegetation that’s prone to burning. A lot of people live in these mountains or right up against them,” said Ryan Aycock, Redfin’s market manager in Salt Lake City. “Many of the homes in Wasatch Range are farm communities or cabins, but there are also luxury homes at risk in Park City, a resort town that’s been very popular during the pandemic. Park City is a mix of vacation and primary homes, but we’ve recently seen an increase of families coming in from Seattle, California and New York to buy primary homes because they can work from anywhere and want to be near great skiing and hiking.”

Aycock continued: “For the most part, the buyers and sellers don’t seem too worried about fires. They’re more concerned about droughts and water shortages,” Aycock said. “We’ve had a lot of near misses in Utah—there will be a fire warning, and then the fire isn’t as bad as people feared. It’s a bit of a boy-who-cried-wolf situation. A lot of folks could be caught flat-footed if a major fire does hit their community. Anyone who’s considering moving to the area should read the local fire planning and evacuation guides and create their own plan of action so they’re prepared when fires hit.”

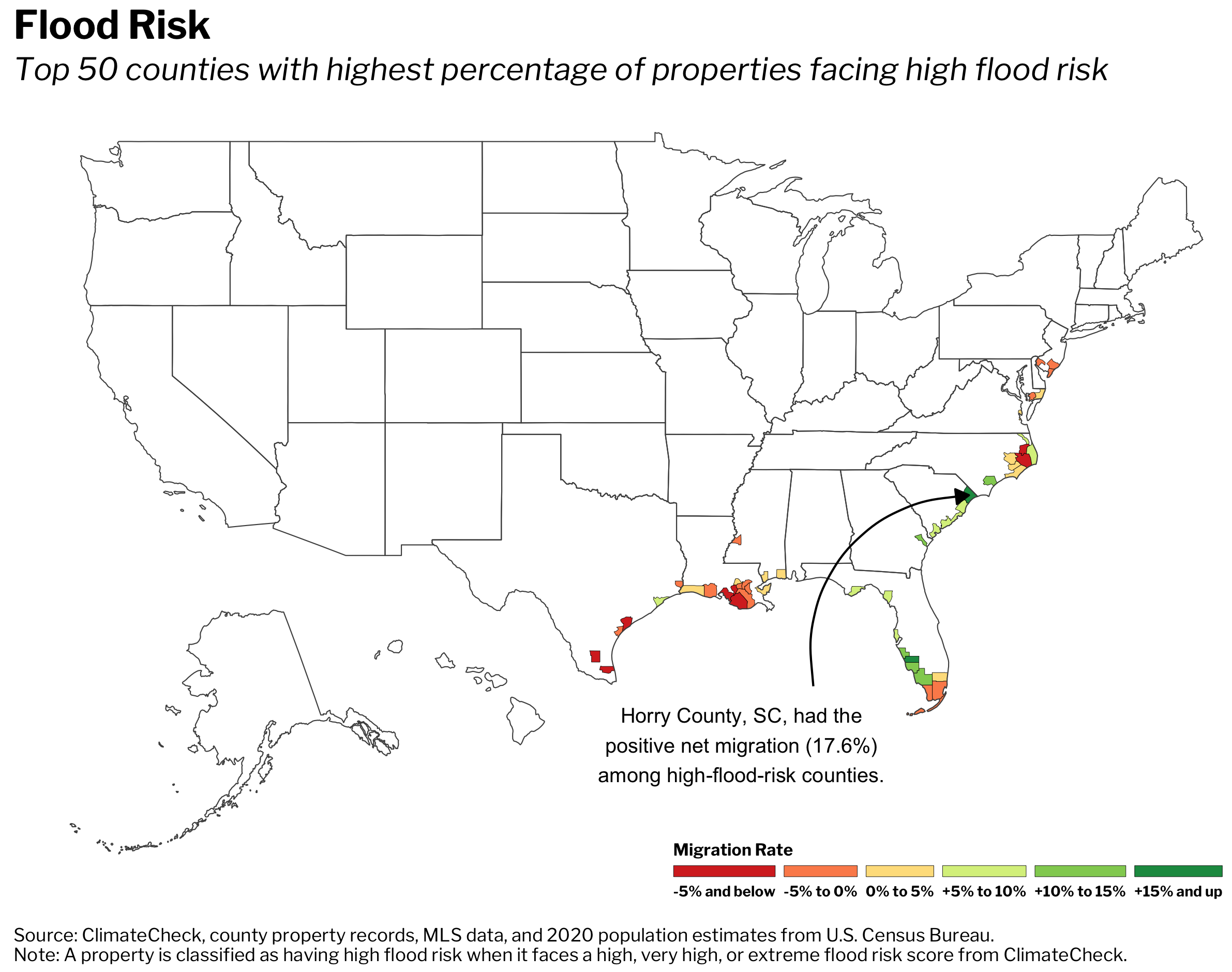

Climate Migration: Counties With High Flood Risk

Flood risk is based on the likelihood of significant flooding between 2020 and 2050. Of the 50 counties with the highest share of properties facing high flood risk, a majority (47) are in the South—specifically in Florida, Louisiana and North Carolina. Just over half (28) of those 50 counties experienced positive net migration from 2016 through 2020.

Horry County, SC, which includes Myrtle Beach, experienced 17.6% population growth from 2016 through 2020 due to positive net migration. That’s the highest increase among the 50 counties Redfin analyzed. It was followed by Charlotte County, FL at 16.8%, Sarasota County, FL (includes Sarasota) at 12.7%, Lee County, FL at 12.7% and Bryan County, GA (just south of Savannah) at 12.2%. All five counties saw their positive net migration rates increase from the prior five-year period.

Top Five High-Flood-Risk Counties By 2016-2020 Net Migration Rate

| Net Migration Rate, 2016-2020 | Net Migration Rate, 2011-2015 | Number of Homes With High Flood Risk | Dollar Value of Homes With High Flood Risk | Share of Homes With High Flood Risk | Median Sale Price (2020) | |

| Horry County, SC | 17.6% | 12.9% | 125,093 | $32,428,236,668 | 54.9% | $219,525 |

| Charlotte County, FL | 16.8% | 11.5% | 81,573 | $26,672,852,475 | 84.3% | $240,742 |

| Sarasota County, FL | 12.7% | 9.2% | 119,551 | $69,558,340,052 | 53.9% | $296,781 |

| Lee County, FL | 12.7% | 11.8% | 295,476 | $121,983,528,367 | 80.3% | $257,717 |

| Bryan County, GA | 12.2% | 9.6% | 7,994 | N/A* | 58.0% | $276,720 |

*Redfin Estimates were not available for given county

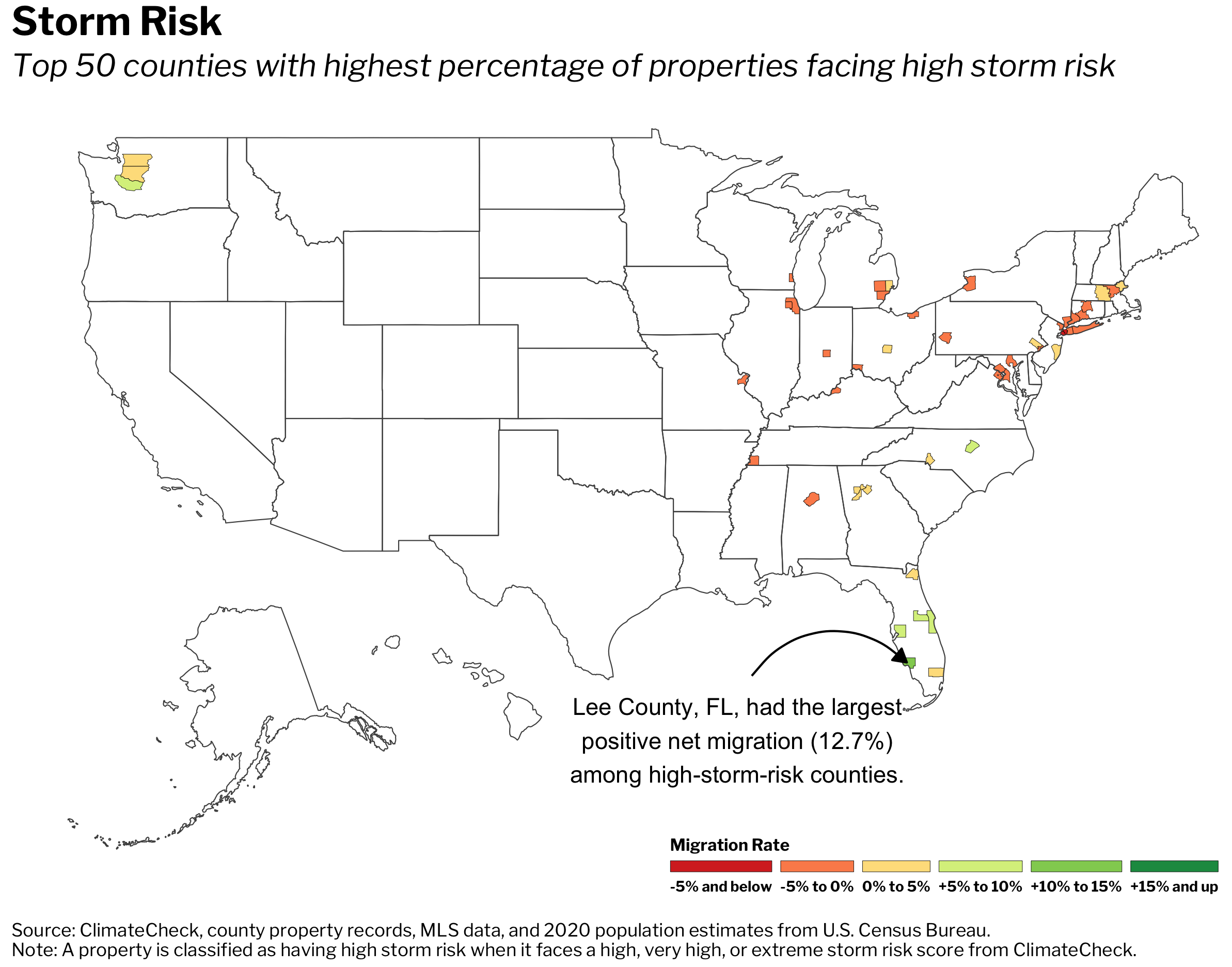

Climate Migration: Counties With High Storm Risk

Storm risk is based on projections of the number of extremely wet or snowy events and the amount of rain or snow that will fall during storms. Of the 50 counties with the highest share of properties facing high storm risk, a majority are in the Northeast or Southeast. While 20 of those 50 counties experienced positive net migration over the past five years, the remainder experienced negative net migration.

Lee County, FL, which includes the cities of Cape Coral and Fort Myers, experienced 12.7% population growth from 2016 through 2020 due to positive net migration. That’s the highest increase among the 50 counties Redfin analyzed. It was followed by Brevard County, FL (includes Cape Canaveral), which had a positive net migration rate of 9.2%. Next came Hillsborough County, FL (includes Tampa) at 7.2%, Wake County, NC (includes Raleigh) at 7% and Pierce County, WA (includes Tacoma) at 5.4%. Three of the five counties saw their positive net migration rates increase from the prior five-year period.

Top Five High-Storm-Risk Counties By 2016-2020 Net Migration Rate

| Net Migration Rate, 2016-2020 | Net Migration Rate, 2011-2015 | Number of Homes With High Storm Risk | Dollar Value of Homes With High Storm Risk | Share of Homes With High Storm Risk | Median Sale Price (2020) | |

| Lee County, FL | 12.7% | 11.8% | 368,149 | $140,838,419,240 | 100% | $257,717 |

| Brevard County, FL | 9.2% | 5.2% | 246,483 | $78,178,439,832 | 100% | $251,809 |

| Hillsborough County, FL | 7.2% | 7.3% | 446,769 | $151,507,295,021 | 100% | $262,507 |

| Wake County, NC | 7% | 7.9% | 369,636 | $152,086,486,189 | 100% | $336,847 |

| Pierce County, WA | 5.4% | 2.8% | 266,983 | $141,600,703,809 | 100% | $415,563 |

Cape Coral, Tampa and Orlando—all of which are prone to hurricanes—were among the 10 most popular migration destinations in the second quarter, and Raleigh has made the list in years past. Meanwhile, Tacoma was named the hottest housing market by Redfin in 2019, fueled by an influx of residents who had been priced out of Seattle.

Of the 50 counties with the greatest share of homes facing high storm risk, Kings County, NY (Brooklyn), Queens County, NY (Queens) and Cook County, IL (Chicago) experienced the greatest population declines due to negative net migration, falling a respective 7%, 6.4% and 4.7% from 2016 through 2020. New York and Illinois were leading the country in population declines even before the pandemic, which exacerbated an exodus from major job centers.

Methodology

Climate-risk data for drought, fire, flood, heat, and storm comes from ClimateCheck, which assigns six different climate-risk categories to properties across the U.S.—very low, low, moderate, high, very high and extreme. For this report, a “high-risk” property is one that falls into the high, very high, or extreme category for a given climate risk. The climate-risk data in this report is as of March 31, 2021.

For each environmental disaster—drought, fire, flood, heat, and storm—we identified the 50 U.S. counties with the largest share of homes facing high risk. Counties must have had at least 500 homes as of Aug. 2, 2021 to be included. We then calculated net migration from 2016 through 2020 and 2011 through 2015. Net migration (the difference between the number of international and domestic people moving into an area and the number moving out) data comes from the U.S. Census Bureau’s Vintage 2020 population estimates. We calculated five-year cumulative net migration by adding each yearly estimate for those years. The value of homes at risk is the sum of the Redfin Estimates of the homes’ market values as of Aug. 2, 2021. We only show dollar values of homes facing high climate risk for those counties covered by Redfin Estimates. Median sale prices for 2020 were calculated by averaging monthly median sale prices during that year.